By [Walton]

Published: September 26, 2024

Trident Limited, a leader in the textile, paper, and chemical industries, has steadily grown over the years. The company’s diverse product portfolio, which includes yarn, towels, bed sheets, and paper, has made it a reliable choice for long-term investors.

In this article, we’ll delve into the share price predictions for Trident Limited from 2024 to 2050, analyzing the company’s performance, future prospects, and key risk factors.

“Explore Trident Ltd’s share price target for 2024 to 2050 with detailed yearly predictions, company insights, competitor analysis, and risk factors. Ideal for investors looking for long-term opportunities.”

What is Trident Ltd (NSE: TRIDENT)?

Trident Limited, established in 1990, is one of India’s largest integrated textile and paper manufacturers. Known for its eco-friendly and high-quality products, the company is recognized for producing home textiles and paper using sustainable practices. With its headquarters in Punjab, Trident exports products worldwide and has strong manufacturing bases in Barnala (Punjab) and Budhni (Madhya Pradesh). The company operates in two main segments: textiles and paper, with a focus on producing top-quality yarn, towels, bed linens, and paper.

Read More: Indian Energy Exchange Ltd (IEX) Share Price Target

Performance in 2023

Trident reported a robust performance in the 2023 financial year, generating a total income of ₹67,903 million, with an EBITDA of ₹9,949 million【Trident Annual Report】. The company posted a profit of ₹3,896 million despite facing challenges such as fluctuating raw material costs. Trident’s commitment to sustainability and innovation, particularly in its paper and textile segments, positioned it for continued growth, even amidst market volatility.

Trident Group Analysis

Trident Share Price Target 2024

Prediction for 2024:

In 2024, Trident’s share price is expected to experience moderate growth as the company strengthens its eco-friendly product offerings. Market conditions suggest a positive trajectory for Trident, driven by strong demand in textiles and paper.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | 40 | 56 |

Summary:

Trident’s steady performance and expanding market presence are likely to keep the share price between ₹40 and ₹56. Investors can expect moderate returns, with steady demand for its textiles and paper products globally.

Trident Share Price Target 2025

Prediction for 2025:

By 2025, Trident’s focus on sustainability, coupled with growing demand for eco-friendly textiles and paper, is expected to push its stock higher. The company’s investments in R&D and green manufacturing practices will further enhance its market share.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 52 | 64 |

Summary:

As the global market increasingly favors sustainable products, Trident’s position as a leader in eco-friendly manufacturing will push its stock price to a range of ₹52 to ₹64. Long-term investors may find this an attractive year for gains.

Trident Share Price Target 2030

Prediction for 2030:

Trident’s long-term vision, focused on global expansion and technological advancements, is expected to drive significant growth by 2030. The company’s adoption of AI and automation in its manufacturing processes will likely boost productivity and profitability.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | 72 | 92 |

Summary:

By 2030, Trident is expected to reach new heights in terms of innovation and sustainability, making it a solid investment for those looking at long-term growth.

Trident Share Price Target 2040

Prediction for 2040:

Looking ahead to 2040, Trident’s focus on eco-friendly solutions and strong market penetration will continue to pay off. The company’s diversification across textiles, paper, and chemicals provides it with multiple revenue streams, reducing risk.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | 245 | 300 |

Summary:

With government initiatives supporting the textile industry and Trident’s robust growth strategy, the stock is poised to reach ₹245-₹300 by 2040.

Trident Share Price Target 2050

Prediction for 2050:

By 2050, Trident’s ability to adapt to market trends, coupled with its strong commitment to sustainability, will likely see the stock hitting new all-time highs. Technological advancements and product diversification will continue to drive its market value.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | 510 | 625 |

Summary:

Trident’s long-term growth potential makes it a strong contender for investors seeking high returns by 2050, with stock prices expected to touch ₹510 to ₹625.

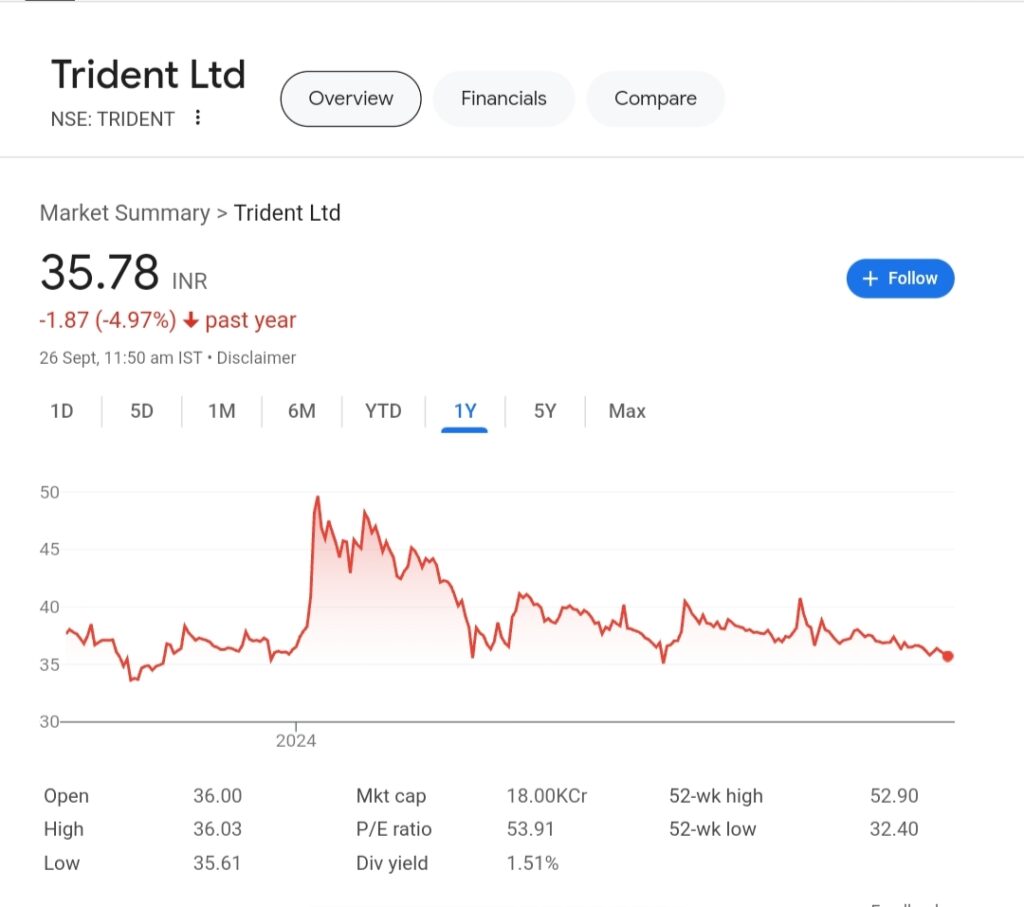

Trident Group Share Price Last 1 Year Data

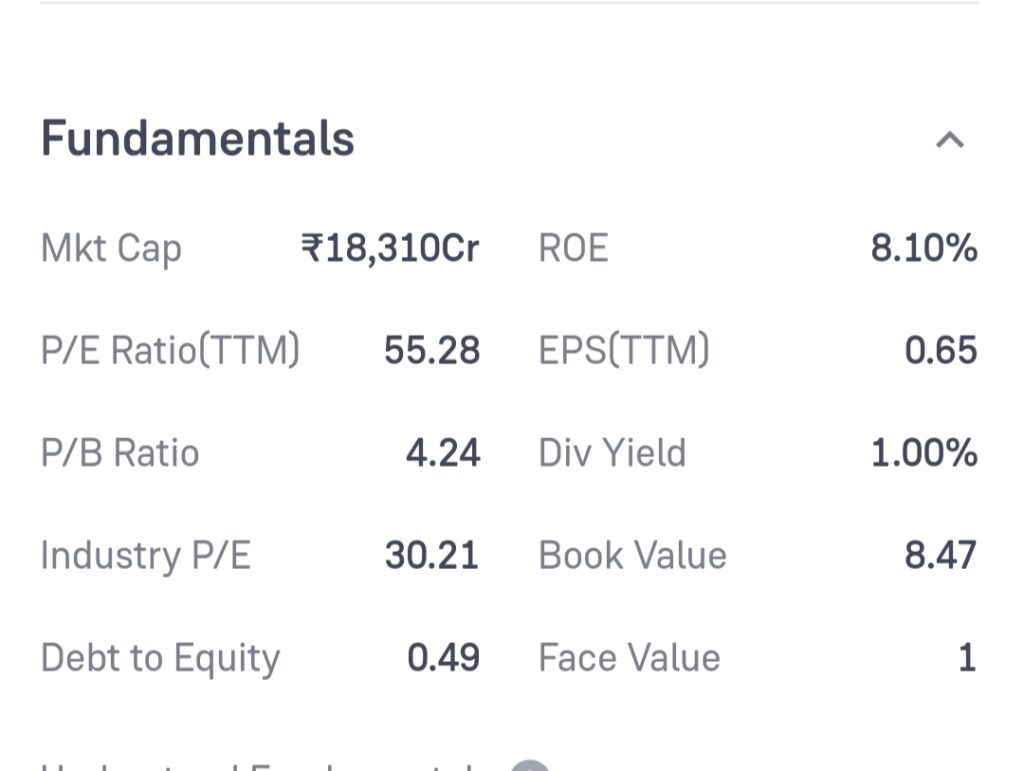

Trident Group Fundamental

Risk Factors

- Raw Material Price Fluctuations: Any significant increase in cotton or chemical prices could impact Trident’s profit margins.

- Competition: Trident faces stiff competition from domestic and international players, such as Vardhman Textiles and Raymond.

- Regulatory Changes: Any changes in government policies or environmental regulations could affect the company’s cost structure.

- Global Market Risks: Economic downturns, particularly in export markets, could reduce demand for Trident’s products.

Competitors

Trident faces strong competition from the following companies:

- Raymond Ltd

- Vardhman Textiles

- Jindal Worldwide

These companies are key players in the Indian textile industry, each offering a diverse range of products that directly compete with Trident’s offerings.

Conclusion

Trident Ltd has shown consistent growth over the years, driven by its commitment to sustainability and innovation. With a diversified product portfolio and a strong market presence, Trident remains a top choice for long-term investors. However, like any investment, it comes with its share of risks, so investors are advised to consider the potential volatility in raw material prices and market conditions.

FAQs

How did Trident stock perform in 2023?

In 2023, Trident saw a steady rise in revenue and profits, closing the year with a total income of ₹67,903 million【Final Annual Report】.

Is Trident a good long-term investment?

Yes, Trident’s diverse business model and focus on sustainability make it a strong option for long-term investors.

What is the outlook for Trident stock by 2050?

By 2050, Trident’s stock is expected to reach between ₹510 and ₹625, driven by its innovative approach and global expansion.

Disclaimer: This is just an estimate that the share target of Trident Group can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.