By- [Jack]

Published: 28 September, 2024

Adani Total Gas Ltd. (NSE: ATGL) has emerged as a leader in India’s natural gas distribution sector. A joint venture between the Adani Group and Total Energies, the company is spearheading India’s transition to cleaner energy by focusing on piped natural gas (PNG), compressed natural gas (CNG), and liquefied natural gas (LNG). With the Indian government’s push towards greener energy solutions, Adani Total Gas is well-positioned for substantial growth in the coming decades.

“Discover the future of Adani Total Gas with share price predictions for 2024, 2025, 2030, 2040, and 2050. Learn about financial growth, competitors, and the company’s role in India’s energy transition.”

Read More: Adani Enterprises Share Price Target

What is Adani Total Gas Ltd?

Adani Total Gas Ltd is a natural gas distribution company that provides piped natural gas (PNG) and compressed natural gas (CNG) to residential, commercial, and industrial customers across India. With a strong presence in over 33 Geographical Areas (GAs) and 94 districts, the company is actively working towards India’s goal of increasing the share of natural gas in the country’s primary energy mix from 6% to 15% by 2030【source】.

Adani Total Gas Share Price Target (Predictions)

2024 Share Price Prediction

In 2024, Adani Total Gas is expected to maintain its upward growth trend due to the rising demand for cleaner fuels and the expansion of its infrastructure. The company’s focus on both PNG and CNG distribution will drive the stock price.

Price Prediction for 2024:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | ₹1,620 | ₹1,820 |

2025 Share Price Prediction

By 2025, Adani Total Gas will likely benefit from further infrastructure investments and its partnership with Total Energies. As natural gas consumption grows across industrial and residential sectors, the stock price could see a steady increase.

Price Prediction for 2025:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹1,920 | ₹2,220 |

2030 Share Price Prediction

By 2030, Adani Total Gas is expected to be one of the leaders in India’s natural gas and clean energy sectors. Its long-term strategy includes the development of LNG outlets and compressed biogas (CBG) plants, which will drive growth and revenue.

Price Prediction for 2030:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | ₹3,020 | ₹3,520 |

2040 Share Price Prediction

By 2040, Adani Total Gas will be a significant player in India’s clean energy revolution, capitalizing on the growing demand for sustainable energy solutions.

Price Prediction for 2040:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | ₹6,020 | ₹8,020 |

2050 Share Price Prediction

Looking ahead to 2050, Adani Total Gas is expected to reach new heights as India completes its transition to greener energy solutions. The company will likely lead in sustainable energy with a solid presence in both urban and rural markets.

Price Prediction for 2050:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | ₹10,020 | ₹12,020 |

Adani Total Gas Ltd Annual Report Highlights (FY 2023-24)

According to the FY 2023-24 Annual Report, Adani Total Gas has shown remarkable financial performance, reporting the following key metrics:

- Revenue: ₹4,813 crore (3% YoY growth)

- EBITDA: ₹1,150 crore (27% YoY growth)

- Profit After Tax (PAT): ₹653 crore (23% YoY growth)【source】.

The company is also leading the charge in developing Compressed Biogas (CBG) and EV charging infrastructure, marking its commitment to sustainable energy and decarbonization efforts.

Pros and Cons of Investing in Adani Total Gas

Pros:

- Strong Market Presence: Adani Total Gas has a significant footprint in India’s natural gas distribution, covering 33 GAs and 94 districts.

- Government Support for Green Energy: With the Indian government pushing for cleaner energy, the demand for natural gas is expected to grow.

- Diversification into New Sectors: The company’s investments in Compressed Biogas (CBG), LNG, and EV charging position it well for future growth.

- Strategic Partnership with Total Energies: The joint venture with Total Energies brings expertise and resources, enhancing Adani’s market position.

- Financial Stability: With consistent revenue growth and strong EBITDA performance, the company has proven its financial resilience.

Cons:

- High Competition: The natural gas distribution sector is highly competitive, with other major players like IGL and Gujarat Gas.

- Regulatory Risks: Changes in government policies related to energy and environmental regulations could impact the company’s operations.

- Infrastructure Costs: Developing and maintaining gas distribution infrastructure can be capital-intensive.

- Dependency on Global Energy Prices: Fluctuations in global energy prices can impact profitability.

- Environmental Concerns: Despite being a cleaner energy alternative, natural gas still faces scrutiny as a fossil fuel.

Competitors of Adani Total Gas

Adani Total Gas operates in a highly competitive sector. Here are five key competitors:

- Indraprastha Gas Ltd (IGL)

IGL operates in the city gas distribution sector, providing PNG and CNG to major cities like Delhi and the National Capital Region. - Mahanagar Gas Ltd (MGL)

MGL is another major player in the natural gas distribution industry, serving Mumbai and its surrounding areas. - Gujarat Gas Ltd (GGL)

Gujarat Gas is the largest city gas distribution company in India, with a widespread network in Gujarat. - Reliance Industries Ltd (RIL)

While mainly known for its presence in petrochemicals and retail, Reliance is investing heavily in clean energy, including natural gas. - Torrent Gas

Torrent Gas is focused on expanding its presence in multiple geographical areas, providing both PNG and CNG.

Adani Total Gas Last One Year Chart

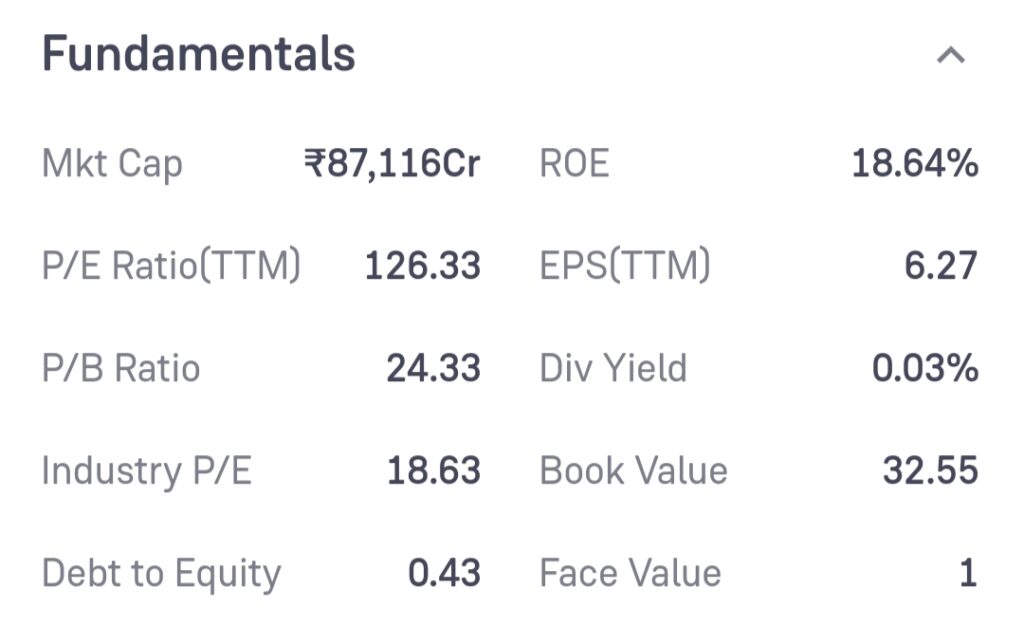

Adani Total Gas Fundamental

Adani Total Gas Quarterly financials

Last 4 Years Compney Profit And Loses

FAQs About Adani Total Gas

Q1: What is Adani Total Gas’ primary business?

Adani Total Gas specializes in distributing natural gas through piped natural gas (PNG) for homes, industries, and businesses, as well as compressed natural gas (CNG) for vehicles.

Q2: Why is Adani Total Gas a good investment?

The company is well-positioned to benefit from India’s shift toward greener energy solutions. With strong backing from the government and strategic partnerships, Adani Total Gas offers significant growth potential.

Q3: What is the role of Total Energies in Adani Total Gas?

Total Energies, a global energy giant, is a joint venture partner with Adani Group in Adani Total Gas. This partnership provides expertise, resources, and industry best practices to drive the company’s growth.

Q4: What are the risks of investing in Adani Total Gas?

Key risks include high competition in the natural gas sector, regulatory risks, and the high cost of infrastructure development.

Q5: How does Adani Total Gas compare to its competitors?

Adani Total Gas competes with major players like Indraprastha Gas and Gujarat Gas. Its strong growth in new areas like EV charging and CBG plants gives it a competitive edge in the energy transition space.

Summary of Adani Total Gas Yearly Price Predictions 2025 to 2050

Here’s a quick summary of Adani Total Gas’ share price predictions for 2024, 2025, 2030, 2040, and 2050:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | ₹1,620 | ₹1,820 |

| 2025 | ₹1,920 | ₹2,220 |

| 2030 | ₹3,020 | ₹3,520 |

| 2040 | ₹6,020 | ₹8,020 |

| 2050 | ₹10,020 | ₹12,020 |

Conclusion

Adani Total Gas Ltd. stands out as a significant player in India’s growing natural gas sector, benefiting from the nation’s transition to cleaner energy. Its strategic partnerships, expansion into new markets like EV charging and compressed biogas (CBG), and commitment to sustainability make it an attractive investment for the long term. However, like any investment, there are risks involved, particularly related to competition, regulatory changes, and infrastructure costs.

Investors looking for growth in the green energy space should consider Adani Total Gas for its strong market position, diversified offerings, and financial stability. With steady growth projections, the company is poised to play a pivotal role in India’s energy future. It’s important to keep an eye on evolving market conditions and regulations to make well-informed investment decisions.

Disclaimer: This is just an estimate that the share target of Adani Total Gas can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.