By- [Walton]

Published: 27 September, 2024

Adani Enterprises Ltd (NSE: ADANIENT) is one of India’s largest diversified conglomerates, known for its operations across industries like energy, infrastructure, and logistics. As a flagship entity of the Adani Group, the company has made significant contributions to India’s economic development, becoming a key player in various sectors.

This article dives into Adani Enterprises’ stock price predictions from 2024 to 2050, offering insight into its future performance, potential growth factors, and key financial highlights from its annual report. Additionally, we’ll compare Adani Enterprises with its competitors and discuss potential risk factors.

“Explore the future prospects of Adani Enterprises with share price predictions for 2024, 2025, 2030, 2040, and 2050. Learn about financial growth, key competitors, and risks involved.”

Adani Enterprises Overview

Founded in 1988, Adani Enterprises Ltd is a diversified business incubator that operates across energy, mining, resources, airports, solar manufacturing, and other key industries. The company’s operations have rapidly grown, with recent achievements reflected in the FY 2023-24 Annual Report. According to the report, Adani Enterprises is focused on nurturing future businesses, including green hydrogen, data centers, and copper smelting.

Adani’s current business portfolio spans multiple sectors that drive the company’s long-term growth and sustainability efforts. Key initiatives include investments in renewable energy, reducing carbon footprints, and expanding infrastructure projects like airports and road networks.

Read More : Indian Infotech Ltd Stock Price Target

Adani Enterprises Share Price Predictions

Stock price predictions are based on a combination of historical performance, financial growth, future projects, and market trends. These predictions are made keeping in mind competitor activities, government policies, and global economic conditions.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | ₹3,520 | ₹4,020 |

| 2025 | ₹4,180 | ₹4,820 |

| 2030 | ₹6,020 | ₹7,520 |

| 2040 | ₹12,020 | ₹16,020 |

| 2050 | ₹20,020 | ₹25,020 |

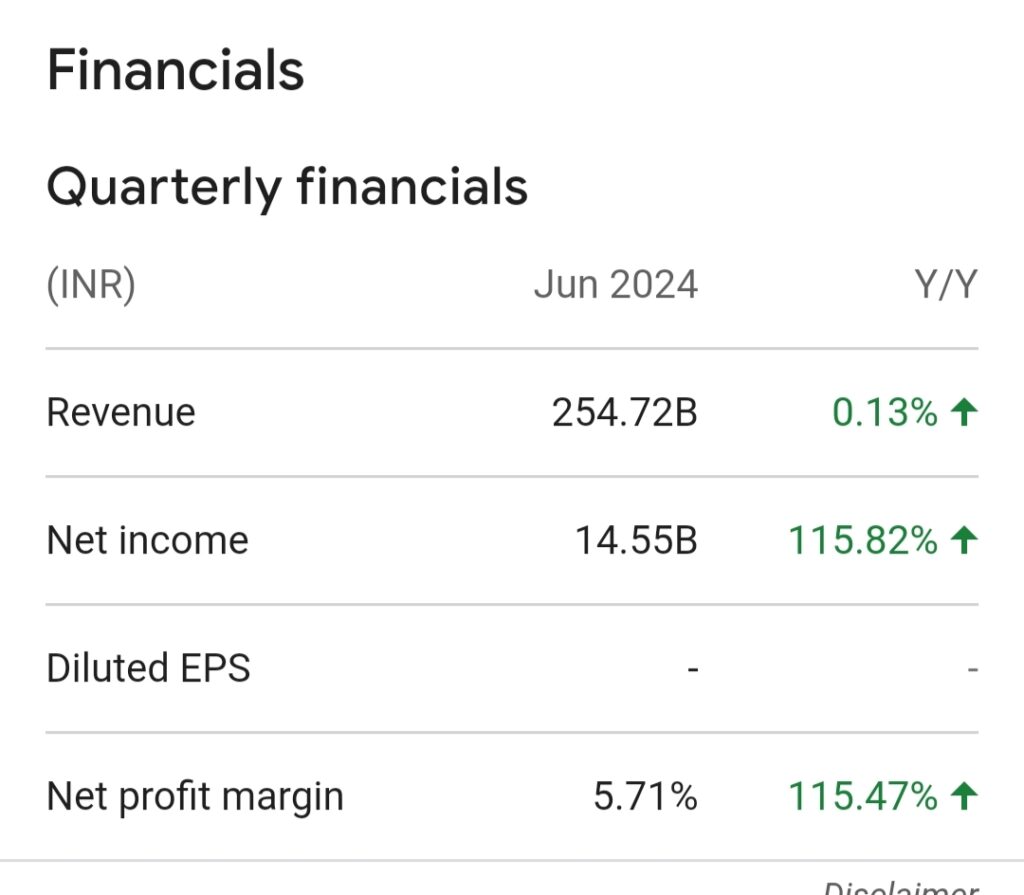

Adani Enterprises Annual Report Highlights (FY 2023-24)

According to the Adani Enterprises Integrated Annual Report 2023-24, the company has reported outstanding performance. Some key metrics include:

- Consolidated Revenue: ₹1,38,194 crore

- EBITDA: ₹13,237 crore

- PAT: ₹3,240 crore【5†source】

Adani Enterprises’ diversified portfolio and continued expansion into green energy and infrastructure projects strengthen its long-term potential. The report emphasizes a focus on Environmental, Social, and Governance (ESG) initiatives, ensuring sustainable growth.

Adani Enterprises Share Price Target 2024

In 2024, Adani Enterprises is expected to continue growing across its diversified sectors. With the company investing heavily in green hydrogen, airports, and infrastructure, the year could bring solid returns for shareholders. The company’s focus on sustainable energy and expansion in critical sectors like mining and logistics will drive its share price.

Key Factors:

- Continued investment in renewable energy (green hydrogen).

- Expansion in airport infrastructure and logistics.

- Government initiatives in infrastructure development.

Price Prediction Table 2024

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | ₹3,520 | ₹4,020 |

Adani Enterprises Share Price Target 2025

By 2025, Adani Enterprises will likely see growth fueled by new ventures in solar manufacturing and airport expansions. The renewable energy push, especially in green hydrogen, is expected to drive the stock value upwards. Additionally, global economic conditions and India’s infrastructure development will play a significant role in determining Adani’s market position.

Key Factors:

- Growth in solar manufacturing and wind energy.

- Stronger demand for airport services as travel recovers.

- Increased investment in digital infrastructure and logistics.

Price Prediction Table 2025

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹4,180 | ₹4,820 |

Adani Enterprises Share Price Target 2030

By 2030, Adani Enterprises is projected to see substantial growth across all sectors, especially in energy and infrastructure. The company’s green hydrogen ecosystem and large-scale renewable energy projects will have matured, positioning Adani as a leader in the clean energy sector. Moreover, the diversification into new ventures like data centers and copper smelting will contribute to the company’s long-term growth.

Key Factors:

- Fully operational green hydrogen ecosystem.

- Large-scale infrastructure projects in renewable energy and logistics.

- New business ventures in copper, airports, and defense.

Price Prediction Table 2030

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | ₹6,020 | ₹7,520 |

Adani Enterprises Share Price Target 2040

Looking forward to 2040, Adani Enterprises will likely be a key player in India’s industrial and infrastructure sectors. With significant investments in clean energy, green hydrogen, and logistics, the company will be poised to take advantage of India’s growing economy. By this time, most of the large infrastructure projects initiated in the 2020s will be fully operational, contributing to the company’s stock growth.

Key Factors:

- Dominance in green hydrogen and renewable energy markets.

- Expansion of international airports and logistics hubs.

- Significant growth in digital infrastructure and data centers.

Price Prediction Table 2040

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | ₹12,020 | ₹16,020 |

Adani Enterprises Share Price Target 2050

By 2050, Adani Enterprises will have established itself as a global leader in infrastructure, energy, and sustainable technologies. The company’s long-term projects in green energy and digital transformation will have fully matured, providing significant returns for investors. The growth in global trade, technological advancements, and continued government support will drive the stock to new highs.

Key Factors:

- Global leadership in green hydrogen and renewable energy.

- Major contributions to India’s infrastructure and economic growth.

- Continued innovation in clean energy, logistics, and digital solutions.

Price Prediction Table 2050

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | ₹20,020 | ₹25,020 |

Summary of Yearly Price Predictions

Here’s a consolidated table for Adani Enterprises share price predictions for the years 2024, 2025, 2030, 2040, and 2050:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | ₹3,520 | ₹4,020 |

| 2025 | ₹4,180 | ₹4,820 |

| 2030 | ₹6,020 | ₹7,520 |

| 2040 | ₹12,020 | ₹16,020 |

| 2050 | ₹20,020 | ₹25,020 |

This comprehensive summary of yearly targets makes it easy for investors to understand Adani Enterprises’ projected growth over time.

Competitors of Adani Enterprises

Adani Enterprises operates in highly competitive sectors. Some of its top competitors include:

- Tata Power (NSE: TATAPOWER)

Tata Power is one of the largest power generation companies in India, with a diversified energy portfolio, including thermal, hydro, solar, and wind energy. - Reliance Industries (NSE: RELIANCE)

A major player in energy, petrochemicals, and retail, Reliance also has ventures into renewable energy, similar to Adani’s green hydrogen projects. - NTPC Limited (NSE: NTPC)

India’s largest power generation company, focusing on conventional and renewable energy sources, NTPC is a direct competitor in the energy sector. - JSW Energy (NSE: JSWENERGY)

Known for its presence in renewable and thermal power generation, JSW Energy has been actively expanding its energy portfolio. - GAIL (India) Limited (NSE: GAIL)

India’s leading natural gas processing and distribution company, GAIL competes with Adani’s ventures in the natural gas sector.

Risk Factors

Although Adani Enterprises has shown substantial growth, investors should consider the following risks:

- High Debt Levels: Adani Enterprises’ expansion strategy has resulted in significant debt, which may limit financial flexibility.

- Environmental Regulations: As a large player in sectors like energy and mining, the company is subject to increasing scrutiny regarding environmental sustainability.

- Global Market Volatility: Fluctuations in global markets and raw material prices can directly affect Adani’s infrastructure and energy projects.

- Competition: Intense competition in core sectors, including energy and logistics, could impact market share and profitability.

Manba Finance Share Price Target

Pros and Cons of Investing in Adani Enterprises

Pros:

- Diverse Business Portfolio:

Adani Enterprises operates across various sectors including energy, mining, logistics, airports, and renewable energy, reducing its dependency on any one sector. - Strong Growth Prospects:

With its focus on new-age businesses like green hydrogen and solar manufacturing, Adani Enterprises is well-positioned to capitalize on the growing global demand for renewable energy. - Government Support:

The company benefits from India’s infrastructure development initiatives, aligning with government projects like Make in India and Green Energy Transition. - Sustainability Focus:

Adani is actively investing in ESG (Environmental, Social, and Governance) initiatives, which are increasingly important for long-term growth and risk management. - Strong Financial Performance:

The company’s robust financial results, as highlighted in its FY 2023-24 annual report, show consistent growth in revenue, EBITDA, and profit.

Cons:

- High Debt Levels:

Adani Enterprises has a high debt-to-equity ratio due to its aggressive expansion, which could affect its financial flexibility during economic downturns. - Environmental Concerns:

Despite its investments in renewable energy, the company’s involvement in sectors like mining and infrastructure subjects it to environmental scrutiny and potential regulatory hurdles. - Global Market Exposure:

Adani’s reliance on international markets and fluctuating commodity prices may pose risks in the face of global economic instability. - Corporate Governance Issues:

The company has faced scrutiny over its corporate governance practices, which may impact investor confidence in the long run. - Competitive Pressure:

Adani operates in highly competitive sectors, including energy and logistics, where established players like Reliance and Tata Power pose significant competition.

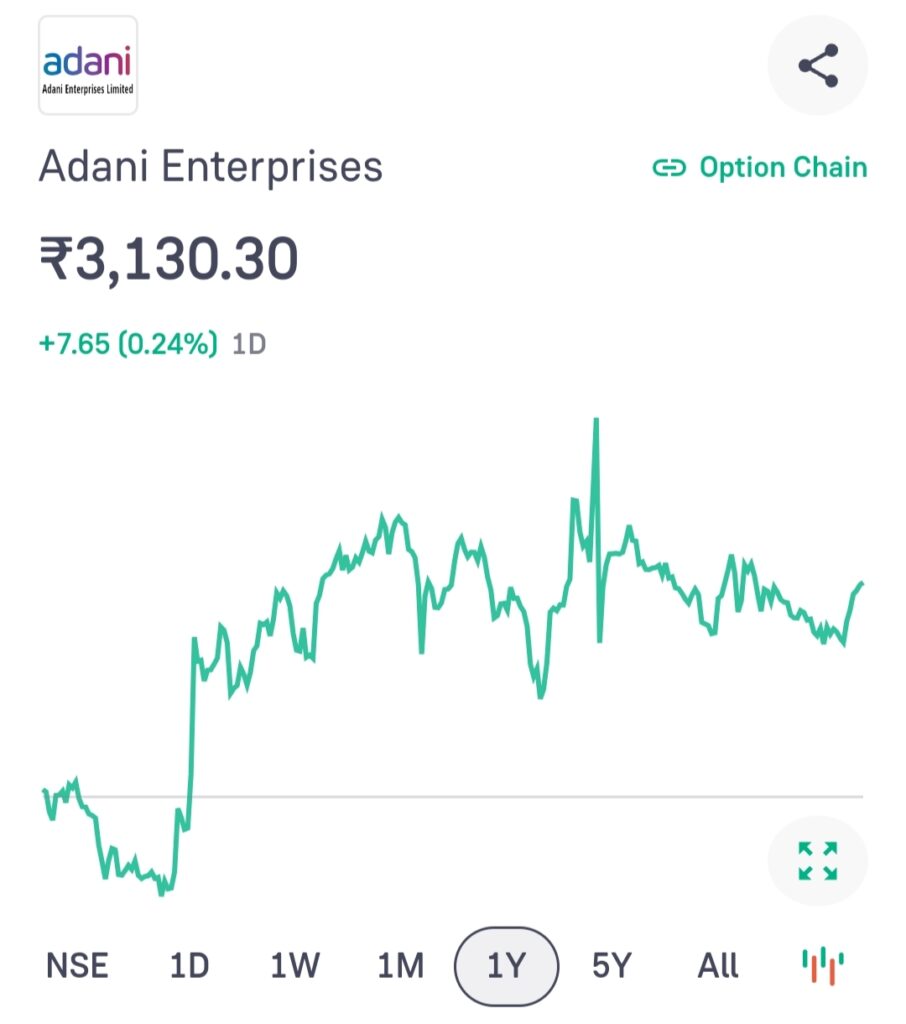

Adani Enterprises Last One Year Chart

Adani Enterprises Fundamental

Adani Enterprises Quarterly financials

Last 4 Years Compney Profit And Loses

Conclusion

Adani Enterprises Ltd. continues to be a significant player in India’s growth story, with ambitious plans for infrastructure, renewable energy, and more. The company’s stock has the potential to grow significantly, making it an attractive option for investors with long-term perspectives. However, one must weigh the risks carefully before making any investment decisions.

By keeping a balanced approach to its diverse business segments, Adani Enterprises can maintain steady growth, ensuring value creation for shareholders while contributing to national economic progress.

FAQs

Q1: What is the main business of Adani Enterprises?

Adani Enterprises operates in energy, mining, logistics, airports, and more. It serves as an incubator for new businesses, including green hydrogen and solar manufacturing.

Q2: Should I invest in Adani Enterprises?

Adani Enterprises offers a diversified business model and strong growth potential, but high debt and market competition should be considered before investing.

Q3: What are the future plans of Adani Enterprises?

Adani plans to expand in green hydrogen, airports, copper smelting, and road networks while focusing on sustainability and reducing carbon footprints.

Q4: How does Adani Enterprises compare to its competitors?

Adani competes with top players like Reliance, Tata Power, and NTPC in energy and infrastructure. Its diversified portfolio offers resilience but faces stiff competition.

Disclaimer: This is just an estimate that the share target of Adani Enterprises can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.