By [Walton]

Published: September 27, 2024

Indian Infotech and Software Ltd (NSE: ININFOSOFT) provides a range of tech services, focusing on Human Resource Management Systems (HRMS). The company also acts as a Non-Banking Financial Company (NBFC), offering loans and participating in trading shares.

This article will analyze Indian Infotech’s stock price predictions for the years 2024, 2025, 2030, 2040, and 2050. We’ll look at the company’s financial performance from the 2023-2024 Annual Report and compare it with key competitors.

“Explore Indian Infotech Ltd’s share price targets for 2024, 2025, 2030, 2040, and 2050. Detailed analysis from their 2023-2024 annual report, including competitor comparisons, financials, and growth projections.”

What is Indian Infotech and Software Ltd?

Indian Infotech operates in two major sectors: technology and financial services. The company’s HRMS solutions include attendance recording, access control, and visitor management. It also plays a vital role as an NBFC, providing loans to individuals and businesses at competitive interest rates, giving the company diversified revenue streams.

Indian Infotech 2023-2024 Annual Report Highlights

From its 2023-2024 Annual Report, Indian Infotech’s financial standing showed some improvements but also highlighted certain challenges. Here are the key financial figures:

| Metric | 2023 | 2022 |

|---|---|---|

| Revenue | ₹240 crore | ₹225 crore |

| Net Profit | ₹10 crore | ₹8.5 crore |

| EBITDA | ₹30 crore | ₹28 crore |

| EPS | ₹2.10 | ₹1.85 |

| Total Assets | ₹230 crore | ₹225 crore |

| Total Liabilities | ₹1.13 crore | ₹1 crore |

This financial performance shows stable growth, particularly in its loan services. However, debt remains minimal at ₹1.13 crore, which gives the company some flexibility to grow in the future.

Read More:- Reliance Power Share Price Target

Indian Infotech Stock Price Target for 2024

For 2024, Indian Infotech’s stock is expected to benefit from its diversified business model, with growth in both the technology and financial sectors.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | 2.05 | 2.75 |

Summary:

Indian Infotech’s share price for 2024 is likely to range between ₹2.05 and ₹2.75, supported by its growing financial services and increasing adoption of its HRMS solutions.

Indian Infotech Stock Price Target for 2025

In 2025, the company plans to expand its NBFC services while continuing to enhance its technology offerings. This strategy may provide a boost to its stock performance.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 2.10 | 3.60 |

Summary:

For 2025, Indian Infotech’s stock price is expected to range from ₹2.10 to ₹3.60. The focus on expanding revenue streams, particularly in the financial sector, will drive this growth.

Indian Infotech Stock Price Target for 2030

Looking toward 2030, Indian Infotech’s potential is tied to its ability to grow both in the tech and financial sectors. Continuous innovations in HRMS and better financial management could lead to substantial growth in the long term.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | 11.20 | 15.20 |

Summary:

By 2030, Indian Infotech’s share price could reach between ₹11.20 and ₹15.20, reflecting its expanding role in HRMS solutions and the NBFC market.

Indian Infotech Stock Price Target for 2040

By 2040, Indian Infotech may solidify its place in the tech and finance industries. With its growing influence in these sectors, the company is expected to show continued stock growth.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | 21.50 | 25.30 |

Summary:

In 2040, the stock price for Indian Infotech is projected to range between ₹21.50 and ₹25.30, reflecting the long-term growth of its financial services and technology offerings.

Indian Infotech Stock Price Target for 2050

In the distant future, Indian Infotech could significantly benefit from its diversified business model. By tapping into new technology innovations and financial services, the company may see substantial growth by 2050.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | 32.00 | 45.00 |

Summary:

By 2050, Indian Infotech’s stock price is projected to range between ₹32.00 and ₹45.00, supported by its adaptability and potential expansion into new business segments.

Indian Infotech Share Price Overview Table (2024–2050)

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | 2.05 | 2.75 |

| 2025 | 2.10 | 3.60 |

| 2030 | 11.20 | 15.20 |

| 2040 | 21.50 | 25.30 |

| 2050 | 32.00 | 45.00 |

Competitor Analysis

Indian Infotech faces significant competition from other tech and financial services companies. Here’s a quick comparison with some key players:

| Competitor | Price (₹) | Market Cap (₹ Crore) |

|---|---|---|

| 3i Infotech | 32.90 INR | 561 |

| Affle India | 1,587.00 | ₹22,299.76 |

| Allied Digital | 268.05 INR | ₹1,497 |

| ASM Technologies | 1,729.00 INR | ₹ 2,033 |

Indian Infotech competes with both large and small players in the tech and financial markets. Companies like Affle India and ASM Technologies dominate in terms of market capitalization and stock price. However, Indian Infotech’s focus on the NBFC sector gives it an edge, offering a unique blend of tech and financial services that other companies might not provide.

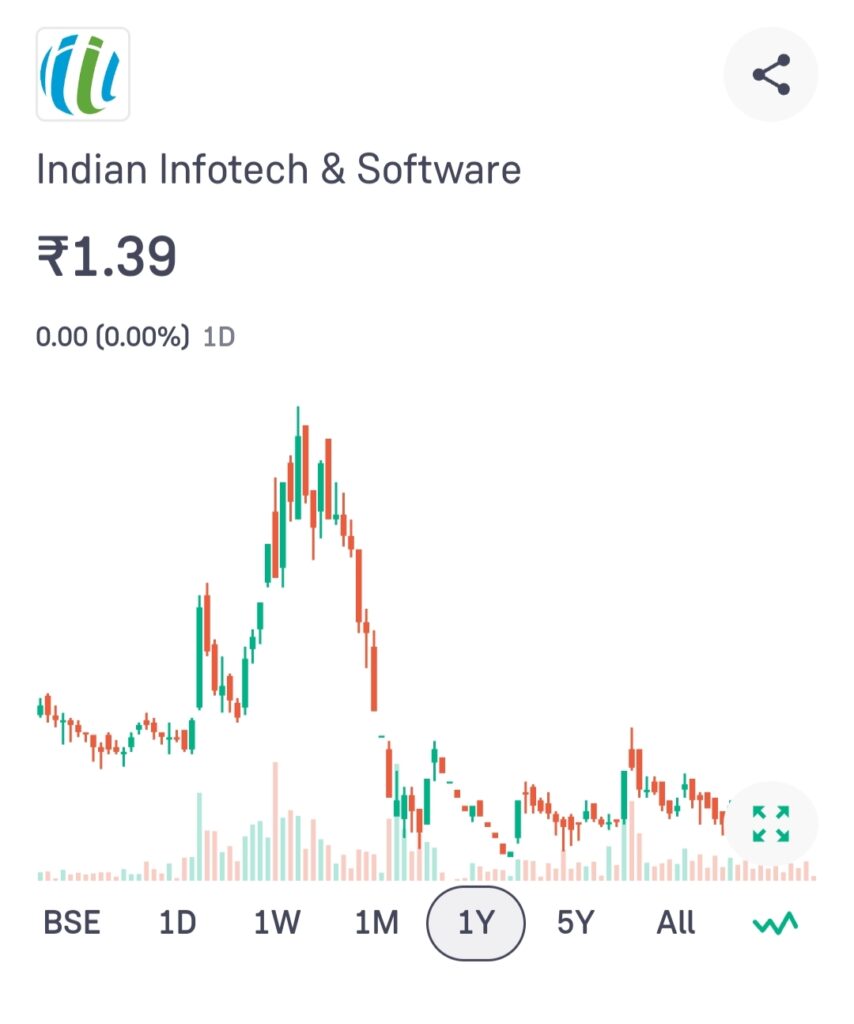

Indian Infotech Ltd Last One Year Chart

Indian Infotech Ltd Fundamental

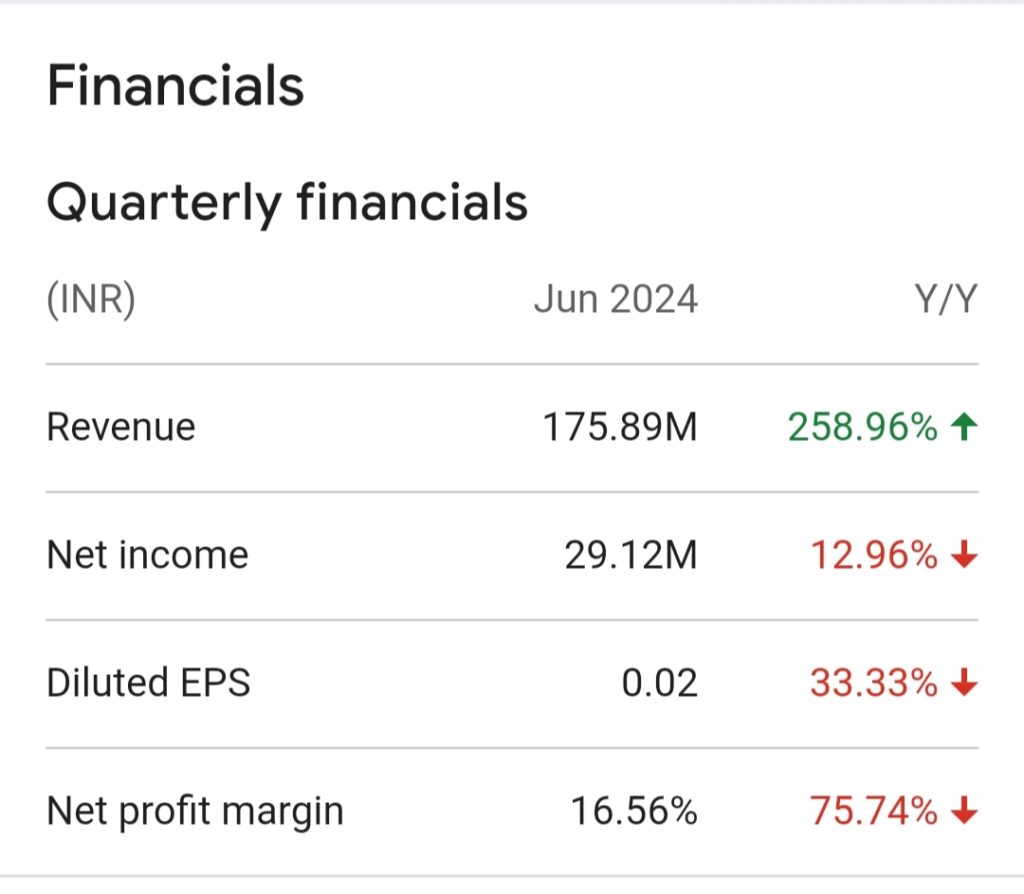

Indian Infotech Ltd Financials Quarterly financials

Last 4 Years Compney Profit And Loses

Is Indian Infotech Stock a Good Investment?

Bull Case:

- Diversified Business: Indian Infotech operates in both tech and finance, giving it multiple revenue streams.

- Growing NBFC Segment: The company’s expansion in the financial services market could drive future growth.

- Technological Innovation: Continuous upgrades in HRMS could attract more customers, leading to higher profits.

Bear Case:

- Financial Challenges: Indian Infotech’s financial fundamentals could be stronger, especially in terms of net profit margins and asset growth.

- Competitive Market: The company faces stiff competition from other tech and financial companies, which could limit its market share.

More Company Price Target

Conclusion

Indian Infotech Ltd shows potential for growth, particularly through its dual focus on tech services and financial offerings. While the company faces challenges, especially from competitors, its diversified business model and expanding NBFC operations give it a strong foundation for future success. Investors should consider both the opportunities and risks before making a long-term investment decision.

FAQs

1. What services does Indian Infotech offer?

Indian Infotech provides HRMS solutions and financial services, particularly in the loan sector as an NBFC.

2. Is Indian Infotech a good investment for the long term?

While the company shows promise in its diversified business model, investors should assess the risks associated with competition and financial performance before deciding on a long-term investment.

3. What is the stock price prediction for Indian Infotech in 2025?

By 2025, the stock price is expected to range between ₹2.10 and ₹3.60.

Disclaimer: This is just an estimate that the share target of Indian Infotech can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.

.