By [Jack]

Published: 26 September 2024

Infosys Ltd (NSE: INFY) is one of the global leaders in technology consulting and digital services. With its robust financial growth and commitment to innovation, Infosys has continuously adapted to technological changes and digital transformations, positioning itself as a go-to partner for businesses across industries.

In this article, we will explore Infosys’ share price targets from 2024 to 2050, along with detailed financial insights, market trends, risk factors, and competitor analysis.

“Discover Infosys Ltd’s share price predictions for 2024, 2025, 2030, 2040, and 2050. Analyze financial performance, business prospects, risk factors, and competitor trends to guide your investment decisions.”

What is Infosys Ltd (NSE: INFY)?

Infosys Limited is one of India’s largest and most well-known IT companies, providing services ranging from software development to IT consulting and outsourcing. With headquarters in Bengaluru, Infosys serves clients globally, offering solutions in automation, cloud services, AI, and cybersecurity. The company’s vast digital expertise helps its clients streamline operations and drive digital transformation, making it a significant player in the global IT landscape.

Read More: Trident Share Price Target

Performance in 2023

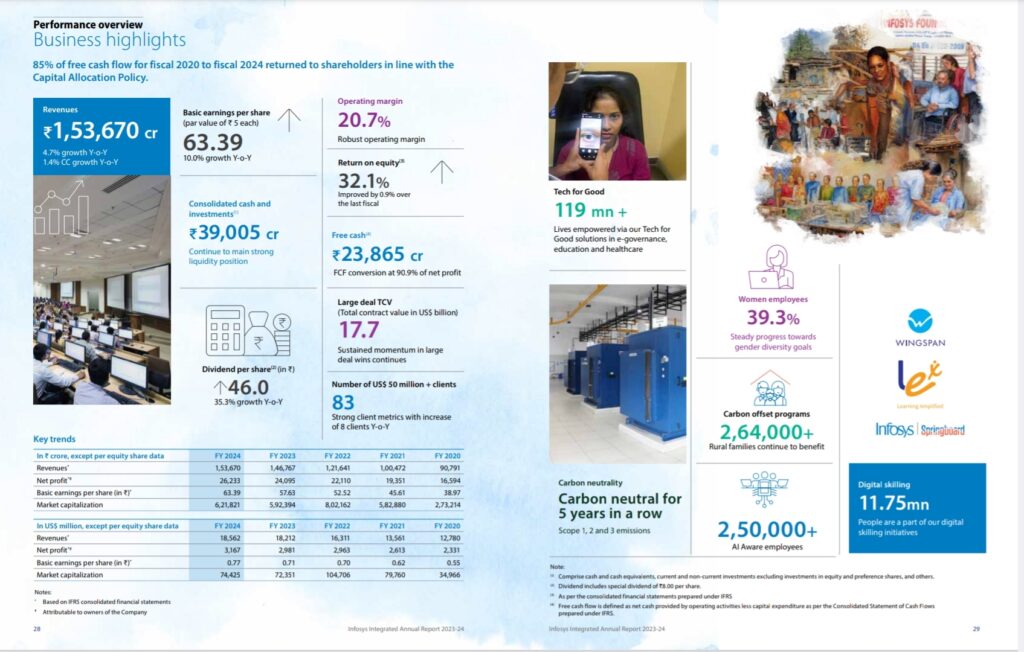

Infosys delivered strong financial results in 2023, with total revenues of ₹1,53,670 crores—a 4.7% growth year-on-year【Infosys Annual Report】. The company’s operating margin stood at 20.7%, demonstrating its ability to maintain profitability amidst global economic challenges. Infosys’ net profit for 2023 was ₹26,233 crores, and the company returned 85% of its free cash flow to shareholders under its capital allocation policy. This robust performance sets the stage for continued growth in the coming years.

Infosys Annual Report

Infosys Share Price Target 2024

Prediction for 2024:

As of 2024, Infosys is expected to maintain its growth trajectory, driven by increasing demand for digital services and cloud solutions. The company’s investments in AI, automation, and digital transformation will likely fuel its share price performance.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | 1,540 | 1,860 |

Summary:

Infosys is expected to see steady growth in 2024, with a price target ranging between ₹1,540 and ₹1,860. The company’s strong digital portfolio and global presence will be key growth drivers.

Infosys Share Price Target 2025

Prediction for 2025:

By 2025, Infosys will likely benefit from the growing demand for IT services across industries such as healthcare, finance, and manufacturing. The company’s emphasis on AI, machine learning, and cybersecurity solutions will boost its share price.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 1,830 | 2,450 |

Summary:

With growing opportunities in the IT sector, Infosys’ share price is projected to reach between ₹1,830 and ₹2,450 by 2025. The company’s partnerships with global businesses will drive revenue growth.

Infosys Share Price Target 2030

Prediction for 2030:

The global technology landscape will significantly evolve by 2030, and Infosys, with its continuous investments in innovation and R&D, will be at the forefront of this revolution. The company’s focus on building partnerships with emerging tech firms will likely contribute to long-term profitability.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | 3,510 | 4,100 |

Summary:

Infosys is expected to achieve significant growth by 2030, with a share price target between ₹3,510 and ₹4,100. The company’s expansion into AI, cloud computing, and quantum computing will further enhance its market position.

Infosys Share Price Target 2040

Prediction for 2040:

By 2040, Infosys will be a major player in digital transformation on a global scale. Technological advancements such as AI, quantum computing, and blockchain will redefine industries, and Infosys’ ability to adapt to these changes will be key to its success.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | 6,900 | 7,800 |

Summary:

Infosys’ long-term growth strategy and its ability to innovate will likely result in a share price range of ₹6,900 to ₹7,800 by 2040.

Infosys Share Price Target 2050

Prediction for 2050:

The year 2050 will see a completely transformed business environment, driven by advancements in AI, automation, and quantum technologies. Infosys is expected to acquire smaller tech companies to expand its global presence, and this strategy will lead to substantial long-term growth.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | 12,500 | 14,500 |

Summary:

By 2050, Infosys is expected to reach new heights, with a share price target ranging from ₹12,500 to ₹14,500. The company’s global expansion and leadership in emerging technologies will drive this growth.

Infosys Share Price Target Overview Table (2024–2050)

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | 1,540 | 1,860 |

| 2025 | 1,830 | 2,450 |

| 2030 | 3,510 | 4,100 |

| 2040 | 6,900 | 7,800 |

| 2050 | 12,500 | 14,500 |

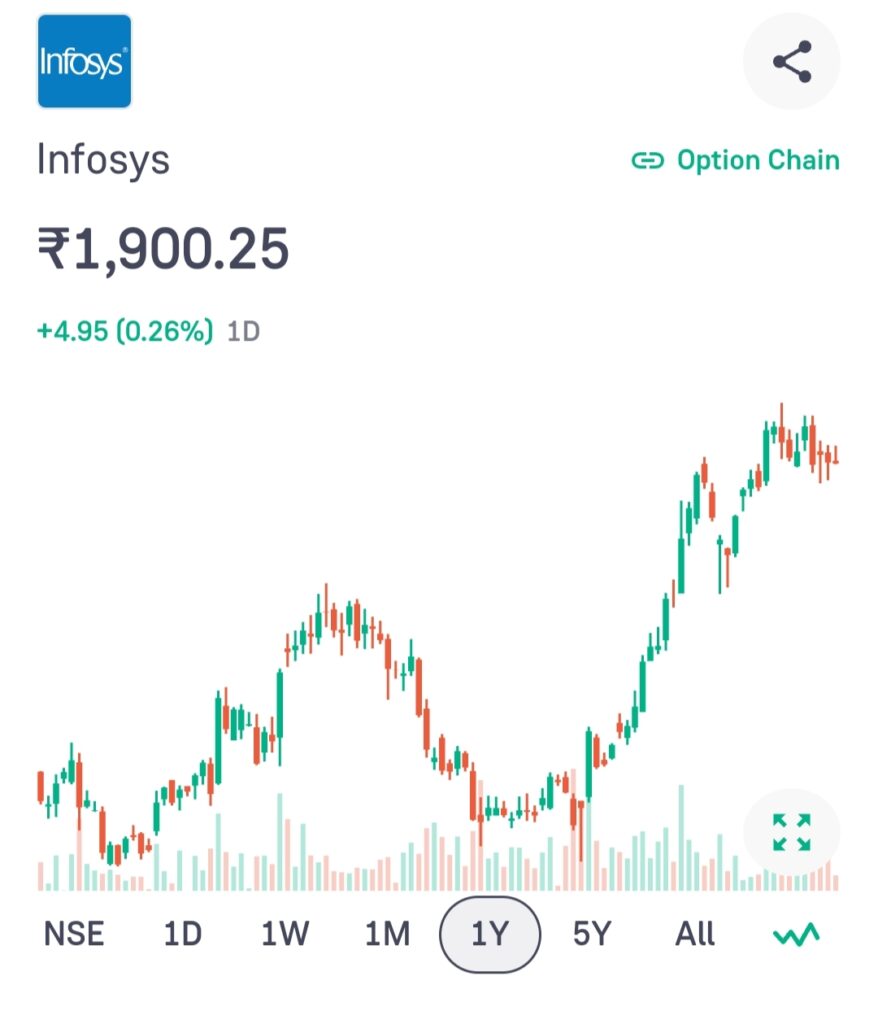

Infosys Share Price Chart Last 1 Year

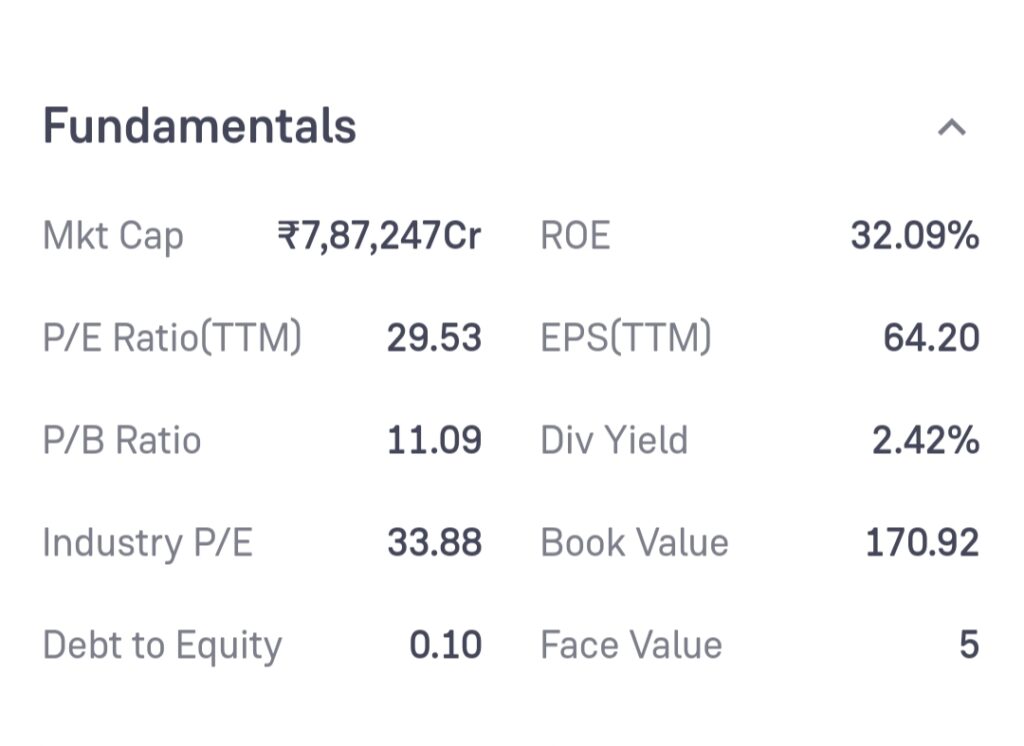

Infosys Fundamental

Risk Factors for Infosys Investors

- Global Economic Uncertainty: Infosys operates in over 46 countries, and its performance is tied to the global economy. Economic downturns, particularly in key markets like the US and Europe, could negatively impact revenue growth.

- Intense Competition: The IT services sector is highly competitive. Companies like Tata Consultancy Services (TCS), Wipro, and HCL Technologies are direct competitors. Intense pricing pressure in the sector may affect Infosys’ margins.

- Technological Disruption: While Infosys is a leader in digital innovation, rapid technological changes, especially in AI, blockchain, and quantum computing, may require constant reinvestment. Failure to keep up with the pace of innovation could result in loss of market share.

- Regulatory Challenges: Infosys is subject to diverse regulatory requirements across multiple countries. Changes in data privacy laws, cybersecurity regulations, and labor laws could impact operational costs and compliance risks.

- Currency Fluctuations: As a company that operates globally, Infosys is exposed to currency risks. Fluctuations in exchange rates, particularly in the US dollar, could affect profitability.

More Price Target

Competitors of Infosys Ltd

Infosys faces strong competition from both domestic and international IT service providers. Some of its major competitors include:

- Tata Consultancy Services (TCS)

TCS is the largest IT services provider in India by market capitalization and revenue. With a broad range of services and a global footprint, TCS is a formidable competitor to Infosys. - Wipro

Another leading IT services provider in India, Wipro offers similar services as Infosys, including IT consulting, cloud services, and cybersecurity. - HCL Technologies

HCL Technologies specializes in digital transformation and offers services that overlap with Infosys’ key business areas, including automation, AI, and enterprise cloud solutions. - Accenture

A global leader in consulting and IT services, Accenture is one of Infosys’ biggest international competitors, especially in North America and Europe. - Cognizant Technology Solutions

Cognizant competes directly with Infosys in IT services, including consulting, enterprise applications, and digital transformation.

Is Infosys Stock a Good Investment? (Bull vs. Bear Case)

Bull Case:

- Technological Leadership: Infosys is a leader in emerging technologies like AI and cybersecurity.

- Strong Financials: The company has strong financial performance, with high revenues, healthy operating margins, and substantial free cash flow.

- Global Expansion: Infosys is expanding into new markets, forming partnerships with leading tech firms, and continuing to innovate.

Bear Case:

- High Competition: Intense competition in the global IT industry could pressure Infosys to lower prices.

- Global Economic Uncertainty: Economic fluctuations in key markets such as the US and Europe may impact Infosys’ growth.

- Regulatory Challenges: Infosys operates in multiple countries, making it vulnerable to regulatory changes and compliance issues.

Conclusion

Infosys Ltd has consistently shown strong growth due to its ability to adapt to new technological trends. With a strong focus on innovation, partnerships, and global expansion, Infosys is positioned to deliver substantial long-term returns for investors. While it faces competition and regulatory challenges, the company’s strengths in emerging technologies will help it remain a top contender in the global IT space.

FAQs

1. Does Infosys Ltd pay dividends?

Yes, Infosys has a consistent track record of paying dividends. In 2024, the company reported a dividend per share of ₹46.00【Infosys Annual Report】.

2. Is Infosys Ltd a good investment?

Infosys is considered a strong long-term investment due to its technological leadership, strong financial performance, and global reach.

3. What is the long-term outlook for Infosys stock?

By 2050, Infosys is expected to achieve significant growth, with its share price potentially reaching ₹12,500 to ₹14,500 due to its leadership in emerging technologies and global expansion.

Disclaimer: This is just an estimate that the share target of Infosys Ltd can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.