By: (Walton) | September 19, 2024

Jio Financial Services Ltd. (JFSL) is quickly gaining momentum in the Indian financial market. In this article, we will explore Jio Finance’s projected share price targets from 2024 to 2040, supported by the company’s current performance, growth potential, and market trends.

About Jio Financial Services Ltd.

Jio Financial Services Ltd. (JFSL) is part of the Reliance Industries conglomerate and is a relatively new player in the stock market, listed in August 2023. Headquartered in Mumbai, Maharashtra, the company was founded by Mukesh Ambani, who has a strong track record of driving growth in different sectors. Jio Financial offers a broad range of services, from digital payments to loan facilities.

Services Offered by Jio Financial

- Digital Payments: A core part of Jio Financial’s offerings.

- Loan Services: Personal loans, home loans, and educational loans.

- Insurance Broking: Jio Financial acts as an intermediary between insurance companies and consumers.

Also Read

IRFC Share Price Target

Jio Financial Share Price Target 2024

The year 2024 is expected to be crucial for Jio Financial Services as the company builds its foundation in the stock market. Based on current trends and market analysis, the projected share prices are:

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 310 | 330 |

| March | 320 | 340 |

| June | 335 | 355 |

| September | 340 | 365 |

| December | 350 | 375 |

With steady growth in revenue and increasing market presence, analysts predict that the company’s stock will remain on an upward trajectory throughout 2024.

Jio Financial Services News Moneycontrol

Jio Financial Share Price Target 2025

In 2025, Jio Financial is expected to expand its loan portfolio and introduce new digital banking services. These innovations could further boost its stock price:

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 360 | 380 |

| March | 370 | 390 |

| June | 380 | 405 |

| September | 395 | 420 |

| December | 410 | 435 |

The forecast suggests Jio Finance could cross the ₹400 mark by the end of 2025, backed by strong revenue growth and expanding service lines.

Jio Financial Share Price Target 2027

Looking ahead to 2027, Jio Financial’s diversification into net banking and other services is likely to drive up the stock price. Here’s what we can expect:

| Year | Share Price Target (₹) |

|---|---|

| Minimum | 440 |

| Maximum | 470 |

Jio Financial will likely establish itself as a dominant player in the Indian financial sector, further increasing its stock value.

Read More

Alok Industries Share Price Target

Jio Financial Share Price Target 2030

By 2030, Jio Financial’s aggressive expansion plans are expected to pay off. The company’s growth in revenue and profits should reflect in its stock price:

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 485 | 515 |

| March | 495 | 530 |

| June | 510 | 545 |

| September | 520 | 560 |

| December | 535 | 575 |

With growing revenue streams from digital banking, payment solutions, and loan services, Jio Finance is expected to make significant strides in the financial markets by 2030.

Jio Financial Share Price Target 2040

Long-term projections for 2040 show tremendous growth potential. By this time, Jio Financial could emerge as a leader in India’s financial services sector, and the stock price could soar:

| Year | Price Target (₹) |

|---|---|

| 1st Target | 2200 |

| 2nd Target | 2300 |

With strong fundamentals and ambitious expansion plans, Jio Finance is poised for success in the coming decades.

Read More

HINDPETRO Share Price Target

Jio Financial Services Share Price Chart

Company Financial Performance

As of March 2024, Jio Financial reported revenues of ₹140 crore, up from ₹134 crore in December 2023. The company’s net profit also increased from ₹70 crore to ₹77 crore over the same period, showcasing strong financial health and potential for future growth.

Advantages of Investing in Jio Financial Services

- Debt-Free: The company operates without debt, a strong indicator of financial stability.

- Profit Growth: Jio Financial is already profitable and has the capacity to expand further.

Disadvantages of Investing in Jio Financial Services

- Low ROE: Return on equity is currently at 4.50%, which is lower than the industry average.

- Profit Margins: Profit after tax (PAT) margins are modest but have room for improvement.

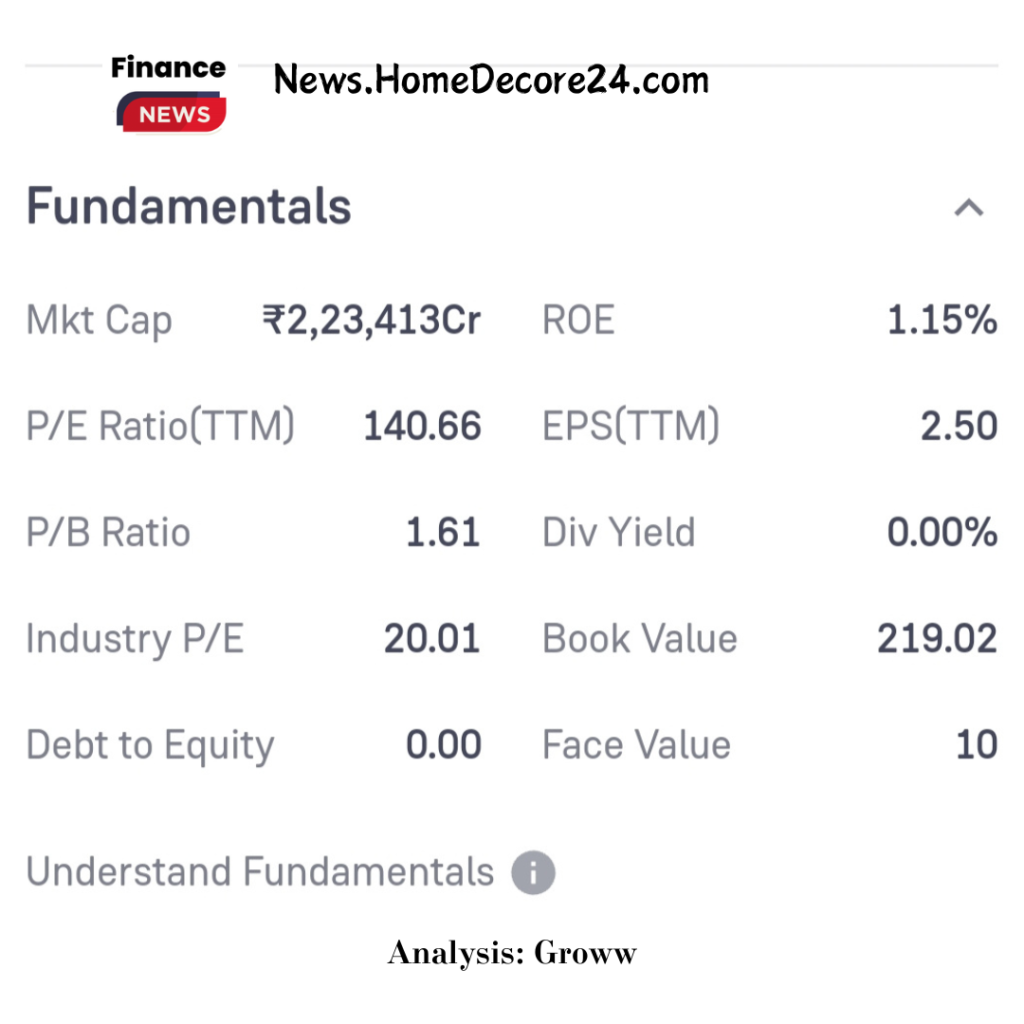

Jio Financial Services Fundamental

Conclusion

Jio Financial Services Ltd. has the potential to become a significant player in India’s financial services industry. With steady growth in revenue, profitability, and new services, the company could provide investors with solid returns over the next two decades. However, market conditions and competition could affect these projections. It’s always advisable to consult a financial expert before making any investment decisions.

FAQs

What is the Jio Financial Share Price Target for 2024?

The projected share price target for 2024 is between ₹310 to ₹375.

What is the Jio Financial Share Price Target for 2025?

In 2025, the share price is expected to range from ₹360 to ₹435.

What is the Jio Financial Share Price Target for 2027?

By 2027, the share price could reach between ₹440 and ₹470.

What is the Jio Financial Share Price Target for 2030?

The 2030 share price target is expected to range from ₹485 to ₹575.

What is the Jio Financial Share Price Target for 2040?

By 2040, the stock price is forecasted to be between ₹2200 and ₹2300.

Who is the CEO of Jio Financial Services Ltd.?

Mr. Hitesh Kumar Sethia is the CEO of Jio Financial Services Ltd.

Disclaimer: The information in this article is meant for educational purposes only and should not be taken as financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Note: This is just an estimate that the share target of Jio Financial can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.

Read More

✓ SBI Card Share Price Target