NTPC Ltd (National Thermal Power Corporation) is one of India’s leading power generation companies, playing a crucial role in meeting the country’s electricity needs.

It is a government-owned entity with a diverse portfolio of power generation assets, including coal, gas, hydro, and renewable energy. As the demand for electricity continues to rise in India, NTPC is strategically positioned to benefit from the growing need for reliable and sustainable power.

This article will delve into NTPC’s share price targets for the years 2024, 2025, 2030, 2040, and 2050. We will analyze its current market conditions, future prospects, analyst opinions, and risk factors to provide a comprehensive outlook for potential investors.

Company Overview

NTPC Ltd, established in 1975, is India’s largest power utility with a total installed capacity of 69,114 MW as of 2024. The company operates 89 power plants, including coal, gas, hydro, and renewable energy projects.

It contributes approximately 22% of India’s total power generation capacity. NTPC is also expanding its portfolio to include more renewable energy sources, in line with the government’s push towards sustainable energy.

The company has a strong financial position, backed by consistent revenue growth and government support. It is actively involved in several joint ventures and subsidiaries focusing on power generation, consultancy, and coal mining.

Read More

✓ SBI Card Share Price Target

Current Market Conditions

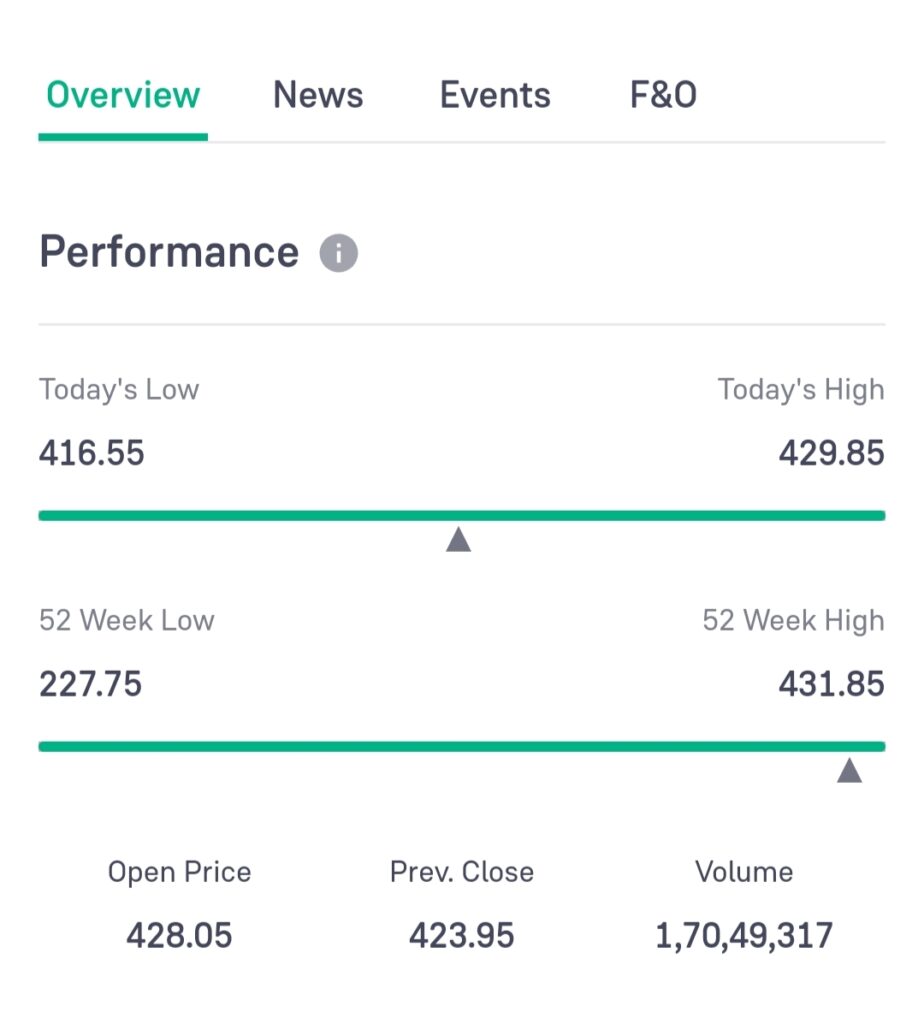

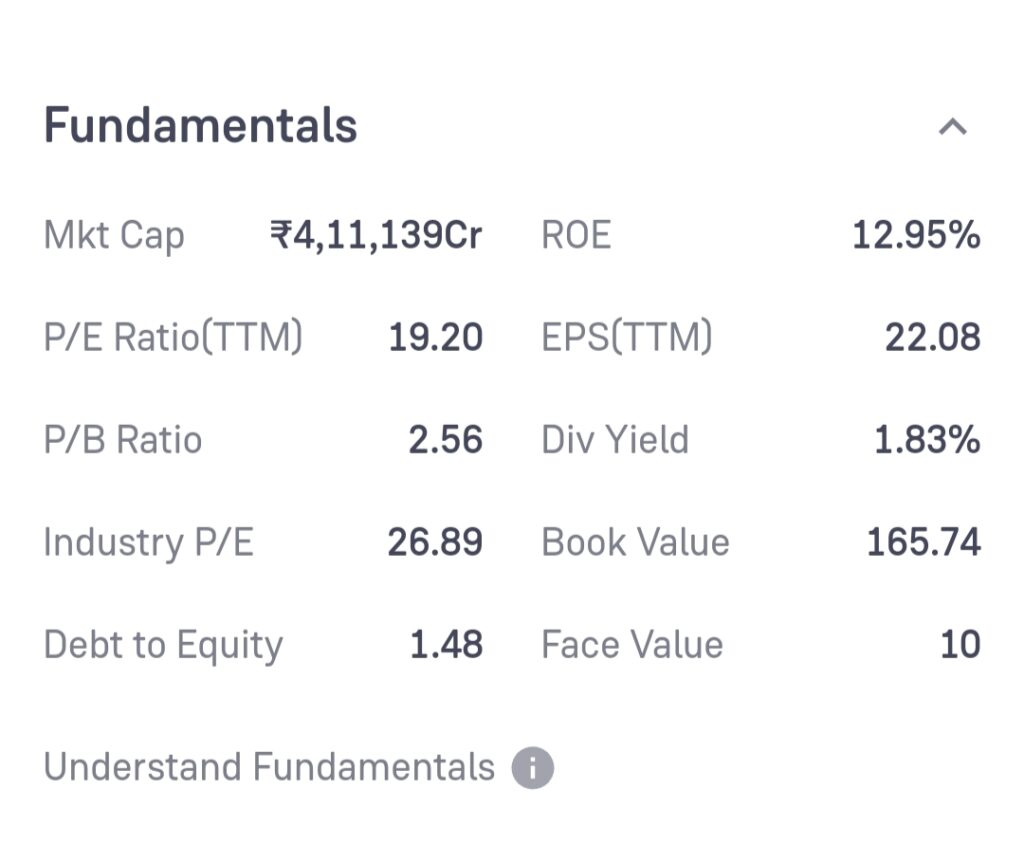

As of September 2024, NTPC’s market capitalization stands at ₹3,48,789 crore, with a P/E ratio of 16.76. The company’s earnings per share (EPS) are ₹21.46, and it has a debt-to-equity ratio of 1.48. Despite the high debt, NTPC’s consistent revenue generation and government backing provide a safety net for investors.

The Indian power sector is undergoing significant transformation with increased emphasis on renewable energy. NTPC’s strategic investments in solar and wind energy projects are expected to boost its future growth prospects.

NTPC Share Price Target Today News Moneycontrol

NTPC Share Price Target 2024

In 2024, NTPC is expected to continue its growth trajectory by focusing on renewable energy and increasing its power generation capacity. With a strong project pipeline and the rising demand for electricity, the share price is likely to see a steady rise.

| Month | Minimum Price (INR) | Maximum Price (INR) |

|---|---|---|

| January | 288 | 318 |

| February | 305 | 340 |

| March | 310 | 350 |

| April | 320 | 360 |

| May | 330 | 380 |

| June | 350 | 400 |

| July | 365 | 420 |

| August | 375 | 450 |

| September | 390 | 480 |

| October | 410 | 510 |

| November | 425 | 540 |

| December | 440 | 580 |

Year Target: ₹290 (Minimum) – ₹580 (Maximum)

Read More

✓ Jio Financial Share Price Target

NTPC Share Price Target 2025

By 2025, NTPC aims to increase its total installed capacity to 75 GW, with a significant portion coming from renewable sources. The company’s commitment to sustainable energy and the government’s supportive policies are expected to attract more investors, potentially pushing the share price higher.

| Month | Minimum Price (INR) | Maximum Price (INR) |

|---|---|---|

| January | 600 | 640 |

| February | 615 | 660 |

| March | 630 | 680 |

| April | 650 | 700 |

| May | 670 | 720 |

| June | 690 | 740 |

| July | 710 | 760 |

| August | 730 | 780 |

| September | 750 | 800 |

| October | 770 | 820 |

| November | 790 | 850 |

| December | 810 | 900 |

Year Target: ₹600 (Minimum) – ₹900 (Maximum)

NTPC Share Price Target 2030

By 2030, NTPC aims to achieve a total installed capacity of 130 GW, with a significant focus on solar and wind energy. The company’s diversification into renewable energy and strategic acquisitions are expected to boost its valuation.

| Month | Minimum Price (INR) | Maximum Price (INR) |

|---|---|---|

| January | 1720 | 1850 |

| February | 1750 | 1880 |

| March | 1780 | 1900 |

| April | 1800 | 1920 |

| May | 1820 | 1940 |

| June | 1840 | 1960 |

| July | 1860 | 1980 |

| August | 1880 | 2000 |

| September | 1900 | 2020 |

| October | 1920 | 2040 |

| November | 1940 | 2060 |

| December | 1960 | 2080 |

Year Target: ₹1720 (Minimum) – ₹2080 (Maximum)

Read More

✓ Alok Industries Share Price Target

NTPC Share Price Target 2040

By 2040, NTPC is expected to be a dominant player in the Asian power market. The company’s strategic investments in technology and capacity expansion are likely to pay off, positioning it as a leader in the renewable energy sector.

| Month | Minimum Price (INR) | Maximum Price (INR) |

|---|---|---|

| January | 3550 | 3650 |

| February | 3580 | 3680 |

| March | 3600 | 3700 |

| April | 3620 | 3720 |

| May | 3650 | 3750 |

| June | 3680 | 3780 |

| July | 3700 | 3800 |

| August | 3720 | 3820 |

| September | 3740 | 3840 |

| October | 3760 | 3860 |

| November | 3780 | 3880 |

| December | 3800 | 3900 |

Year Target: ₹3550 (Minimum) – ₹3900 (Maximum)

NTPC Share Price Target 2050

By 2050, NTPC is expected to be a global leader in power generation, with a diversified portfolio across multiple countries. The company’s long-term vision and sustained growth strategy should continue to attract investors, making it a solid investment for the long term.

| Month | Minimum Price (INR) | Maximum Price (INR) |

|---|---|---|

| January | 4900 | 5000 |

| February | 4950 | 5050 |

| March | 5000 | 5100 |

| April | 5050 | 5150 |

| May | 5100 | 5200 |

| June | 5150 | 5250 |

| July | 5200 | 5300 |

| August | 5250 | 5350 |

| September | 5300 | 5400 |

| October | 5350 | 5450 |

| November | 5400 | 5500 |

| December | 5450 | 5600 |

Year Target: ₹4900 (Minimum) – ₹5600 (Maximum)

Read More

PNB Share Price Target

Analyst Opinions and Future Prospects

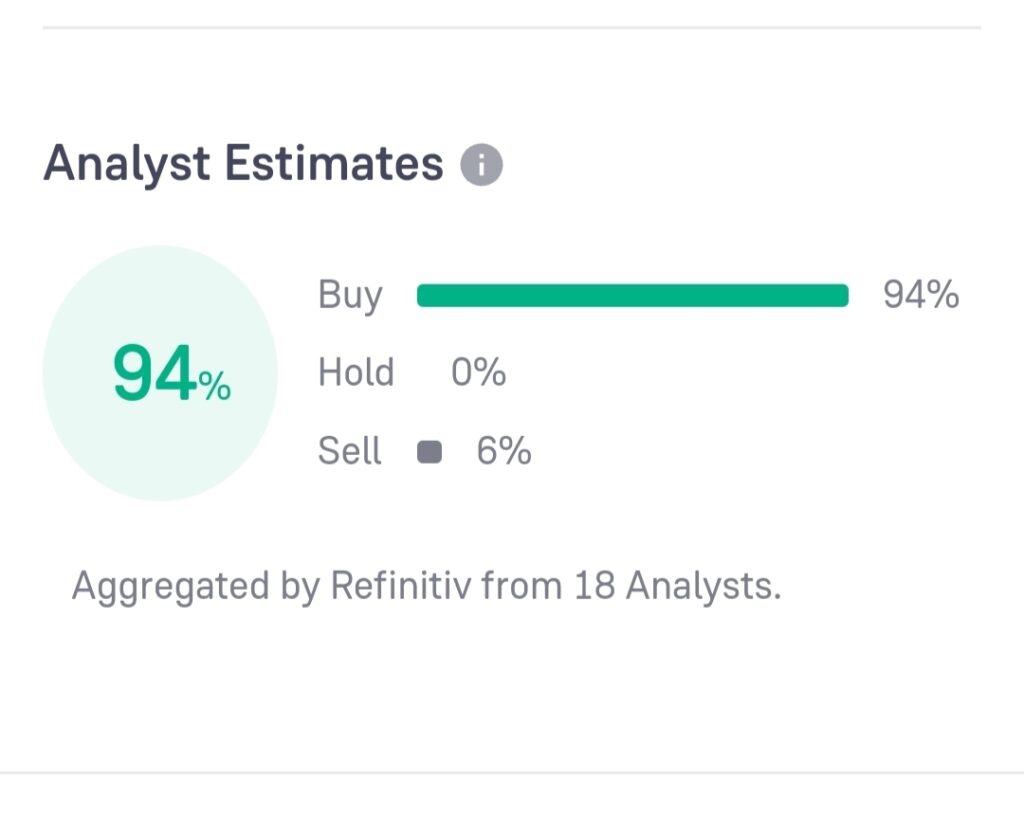

Analysts are optimistic about NTPC’s growth potential, given its strong project pipeline and focus on renewable energy. The company’s commitment to sustainability and government backing make it a promising investment.

However, investors should consider potential risks such as regulatory changes, high debt levels, and competition from private players in the renewable energy sector.

Risk Factors

- High Debt Levels: NTPC’s expansion plans require significant capital, leading to high debt levels. Any downturn in revenue could impact its ability to service this debt.

- Regulatory Changes: Changes in government policies or regulations in the energy sector could impact NTPC’s operations.

- Competition: The entry of private players in the renewable energy sector could increase competition, potentially affecting NTPC’s market share.

NTPC Share Price Chart

NTPC Performance

NTPC Share Buy Hold or Sell

NTPC Shar Fundamental

Conclusion

NTPC Ltd is well-positioned for long-term growth, supported by its robust expansion plans and government backing. While there are risks associated with high debt and competition, the company’s focus on renewable energy and capacity expansion make it a promising investment for the future.

Investors looking for a stable and growing company in the power sector should consider NTPC as a part of their portfolio.

FAQs

Why should I invest in NTPC?

NTPC is a leading power generation company with a diversified portfolio and strong government support.

Disclaimer: The information in this article is meant for educational purposes only and should not be taken as financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Note: This is just an estimate that the share target of NTPC can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.