By [Walton]

Published: September 26, 2024

Reliance Power Ltd (NSE: RPOWER) is a well-known company in India that produces electricity through various means, such as coal, gas, and renewable sources like solar and wind energy. It plays a significant role in meeting the power needs of the country, especially with large projects like the Sasan Ultra Mega Power Project in Madhya Pradesh.

In this article, we will discuss Reliance Power’s share price predictions for the years 2024, 2025, 2030, 2040, and 2050, including insights into its performance, future prospects, and risk factors.

“Explore the predicted share prices of Reliance Power for 2024, 2025, 2030, 2040, and 2050. Learn about the company’s performance, future growth opportunities, and risks involved.”

What is Reliance Power Ltd?

The is a part of the Reliance Group, owned by Anil Dhirubhai Ambani. It is engaged in the construction, development, and operation of power projects in India and abroad. The company uses various energy sources, including coal, gas, solar, and wind. A major project of Reliance Power is the Sasan Ultra Mega Power Plant, which generates 3,960 megawatts of electricity and significantly contributes to the country’s power supply.

Read More: Infosys Share Price Target

Reliance Power’s Share Price Performance in 2023

Reliance Power faced challenges in the past due to high debt ( Total debt on the balance sheet as of March 2024 : $2.25 B) and losses, which led to a decline in its stock price. However, in 2023, the company began showing signs of recovery. The management’s focus on reducing debt and improving operational efficiency has resulted in a gradual increase in its stock price. Reliance Power’s efforts in renewable energy and cost management have given it a fresh perspective for the future.[ Reliance Power Annual Report]

Reliance Power Share Price Target for 2024

In 2024, Reliance Power’s share price is expected to stabilize as the company focuses on debt reduction and completing its ongoing projects. Investors are watching closely as the company navigates through a phase of recovery.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | 21 | 38 |

Summary:

By 2024, Reliance Power’s share price is expected to range between ₹21 and ₹38. The company’s strategic efforts in debt reduction and energy projects will play a crucial role in this growth.

Reliance Power Share Price Target for 2025

The demand for electricity in India is expected to grow significantly in the coming years. Reliance Power is positioning itself to capitalize on this demand by improving its production capacity and reducing debt. These factors could drive up its share price by 2025.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 41 | 53 |

Summary:

By 2025, Reliance Power’s stock could rise to between ₹41 and ₹53, driven by growing demand for electricity and the company’s focus on expanding its energy production.

Reliance Power Share Price Target for 2030

Looking ahead to 2030, Reliance Power will benefit from advancements in technology and increased demand for renewable energy. The company’s focus on clean energy projects like solar and wind power will help it become a major player in the energy sector.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | 78 | 95 |

Summary:

By 2030, Reliance Power is expected to see significant growth, with share prices between ₹78 and ₹95 as it expands its renewable energy portfolio.

Reliance Power Share Price Target for 2040

In 2040, Reliance Power is predicted to achieve new milestones in the power sector, thanks to its focus on sustainable and renewable energy. The company’s long-term strategies are likely to pay off, pushing its stock to new heights.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | 191 | 238 |

Summary:

By 2040, Reliance Power’s share price could range from ₹191 to ₹238, driven by technological innovations and a strong position in the renewable energy market.

Reliance Power Share Price Target for 2050

By 2050, Reliance Power is expected to lead the market in renewable energy production. The company’s strong presence in solar and wind energy, combined with its experience in coal and gas power generation, will likely lead to substantial growth in its stock price.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | 398 | 678 |

Summary:

In 2050, Reliance Power’s stock price could range between ₹398 and ₹678 as the company dominates the renewable energy market.

Reliance Power Share Price Overview Table (2024–2050)

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | 21 | 38 |

| 2025 | 41 | 53 |

| 2030 | 78 | 95 |

| 2040 | 191 | 238 |

| 2050 | 398 | 678 |

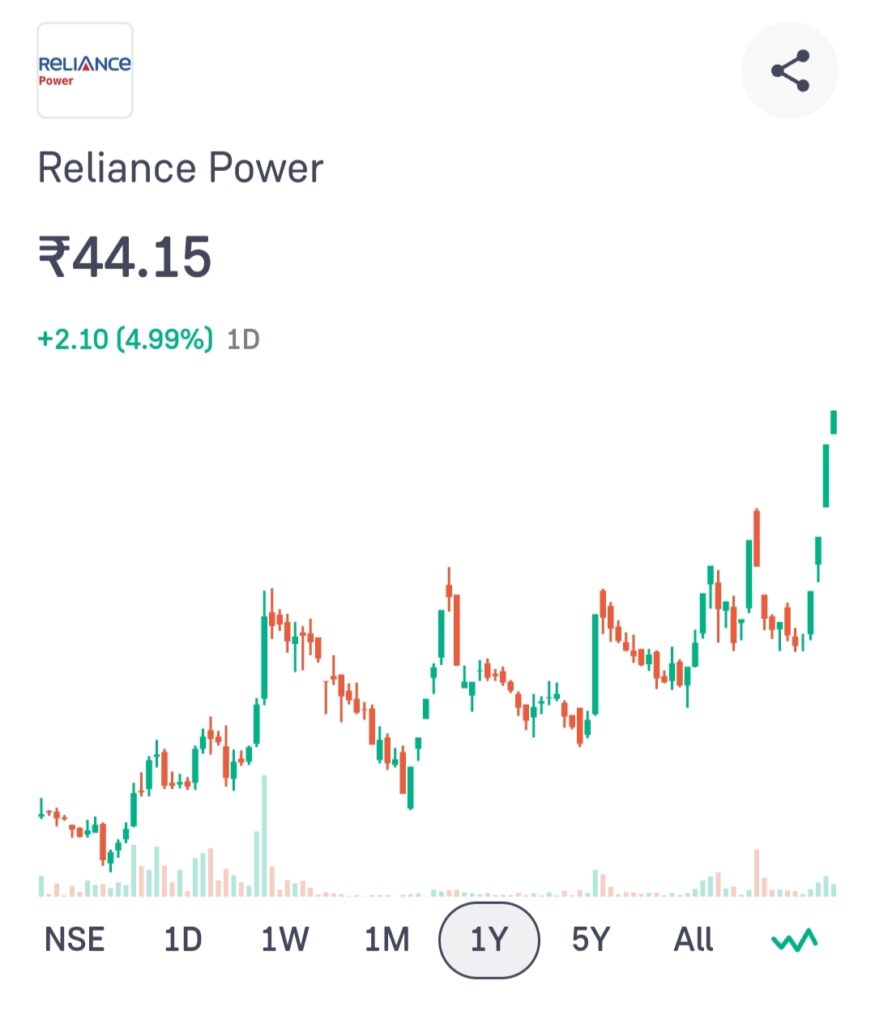

Reliance Power Share Price Chart 📉 Last 1 Year

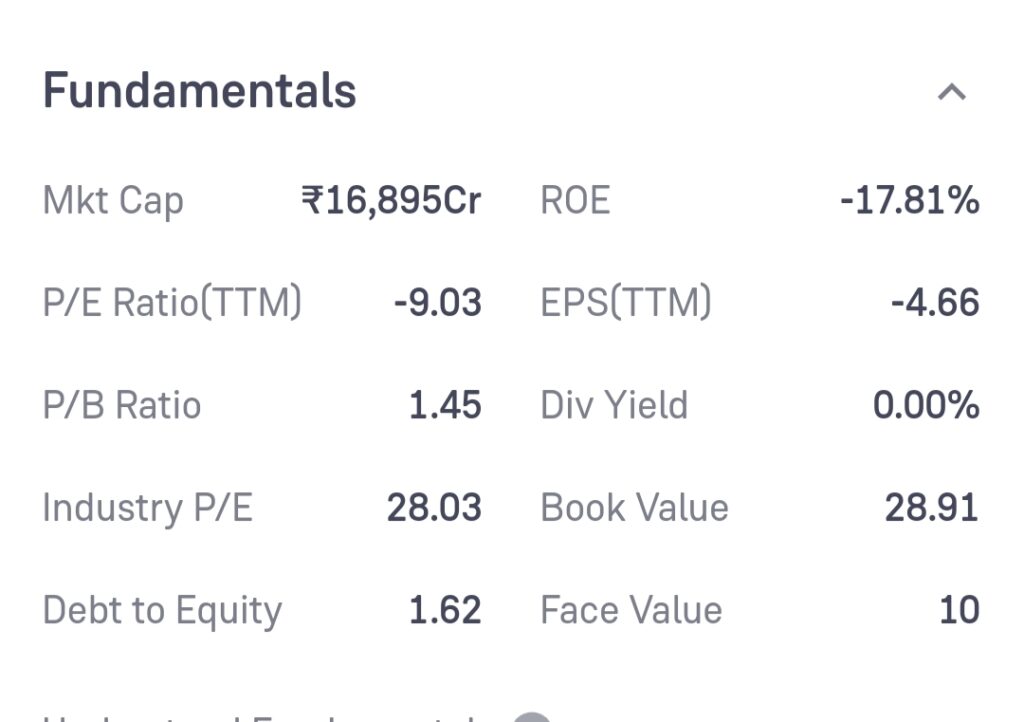

Reliance Power Fundamental

Risk Factors for Reliance Power Investors

- High Debt: Although Reliance Power is working on reducing its debt, it still remains a significant risk. High debt can impact profitability and limit future growth opportunities.

- Market Competition: Reliance Power faces tough competition from other power companies in India, including Tata Power and NTPC.

- Regulatory Challenges: Changes in government policies, especially around energy tariffs and environmental regulations, can affect the company’s operations.

- Technological Disruptions: Rapid changes in energy technology, such as advancements in battery storage or nuclear energy, could affect Reliance Power’s current business model.

- Economic Uncertainty: Fluctuations in the economy, particularly in energy demand and costs, could impact the company’s revenue and stock price.

Is Reliance Power a Good Investment?

Bull Case:

- Renewable Energy Focus: Reliance Power’s shift towards renewable energy, including solar and wind power, positions it well for long-term growth.

- High Demand for Electricity: With India’s growing population and increasing demand for energy, Reliance Power is well-positioned to meet future needs.

Bear Case:

- Debt Risk: High levels of debt could hamper future growth and profitability.

- Competitive Market: The company faces strong competition from other players in the energy sector, which could impact its market share.

Conclusion

Reliance Power is gradually recovering from past setbacks and is positioning itself as a key player in the energy sector, with a focus on renewable energy. Although there are risks involved, including high debt and competition, the company’s long-term growth prospects are promising, especially as demand for electricity increases and renewable energy becomes more important. Investors should keep an eye on Reliance Power as it continues to expand its energy production capabilities.

FAQs

1. Is Reliance Power a good long-term investment?

Reliance Power is focusing on renewable energy, which has long-term growth potential. However, investors should consider the risks, especially related to debt and market competition.

2. What are Reliance Power’s future plans?

The company aims to increase its focus on renewable energy projects, including solar and wind power, while reducing its debt.

3. What factors influence Reliance Power’s share price?

The company’s financial performance, market demand for electricity, government policies, and competition all play a role in influencing its stock price.

Disclaimer: This is just an estimate that the share target of Reliance Power can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.