By Walton

Published on: September 29, 2024

Tata Motors is one of India’s largest and most trusted automobile manufacturers, known for innovation and commitment to sustainability. With an extensive range of commercial and passenger vehicles, Tata Motors also leads the electric vehicle (EV) market in India.

Under the leadership of Natarajan Chandrasekaran, the company is making strides toward sustainable growth, aiming to achieve net-zero GHG emissions by 2040 in passenger vehicles and 2045 in commercial vehicles.

In this article, we will explore Tata Motors’ price predictions for the upcoming decades, analyze its growth strategy, financial performance, risks, and future plans, and how it compares to its competitors.

“Discover Tata Motors’ share price target predictions for 2024, 2025, 2030, 2040, and 2050. Explore the company’s growth, financials, risks, and future plans in this easy-to-understand.”

Company Overview and Background

Tata Motors, a part of the Tata Group, was established in 1945. It manufactures a wide range of vehicles, including cars, trucks, buses, and electric vehicles. The company’s most prominent brands are Jaguar Land Rover and the Tata Passenger Vehicles division, which has gained significant market share in India’s EV space. As of 2024, Tata Motors holds a 70%+ market share in the 4-wheeler EV segment in India.

Tata Motors’ Products and Services

- Passenger Vehicles: The company offers a variety of passenger cars, including electric models like the Tata Nexon EV and Tigor EV.

- Commercial Vehicles: Tata is India’s largest commercial vehicle manufacturer, providing trucks, buses, and small cargo vehicles.

- Electric Vehicles (EVs): Tata Motors leads in EV innovation with 10 models planned by FY26, including fully electric buses and cars.

- Jaguar Land Rover (JLR): A luxury segment focused on electrifying its portfolio, targeting net-zero emissions by 2039.

Financial Performance and Market Cap

In FY24, Tata Motors reported a market capitalization of ₹4.37 lakh crore (INR 36.53 trillion)【source】. The company achieved record revenue of ₹4,37,928 crore with EBITDA margins at 14.3%, and it has set a strong financial foundation for future growth.

Read More: Adani Green Share Price Target

Tata Motors Share Price Target Predictions

1. Share Price Target for 2024

With Tata Motors’ continued dominance in the Indian EV market and strong financial performance in FY24, the stock is expected to rise in 2024. Market analysts project:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2024 | 700 | 1,250 |

Summary for 2024: Tata Motors’ share price in 2024 is predicted to experience strong growth, largely driven by its EV leadership and consistent expansion in commercial and passenger vehicle segments.

2. Share Price Target for 2025

By 2025, Tata Motors is expected to further strengthen its market presence through innovations in both electric and luxury vehicle segments.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 1,100 | 1,560 |

Summary for 2025: Strong sales from the Jaguar Land Rover division and an expanding EV lineup will likely boost Tata Motors’ stock value by 2025.

3. Share Price Target for 2030

By 2030, Tata Motors is forecasted to be a global leader in EV production, significantly increasing its market cap and stock value.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | 2,500 | 3,200 |

Summary for 2030: Continued innovations in electric and autonomous vehicles, along with expanding global sales, will make Tata Motors a formidable player in the automobile industry.

4. Share Price Target for 2040

Looking further ahead to 2040, Tata Motors’ advancements in sustainable mobility, autonomous driving, and hydrogen fuel technologies will greatly enhance its stock performance.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | 4,400 | 5,200 |

5. Share Price Target for 2050

By 2050, Tata Motors is expected to dominate the electric and hydrogen-powered vehicle market globally.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | 8,400 | 9,700 |

Tata Motors Annual Report 2024 – Key Highlights

| Metric | FY22 | FY23 | FY24 |

|---|---|---|---|

| Revenue (₹ Crore) | 2,78,454 | 3,45,967 | 4,37,928 |

| EBITDA Margin | 9.6% | 10.7% | 14.3% |

| Profit After Tax (₹ Crore) | (11,309) | 2,690 | 31,807 |

Summary: Tata Motors saw a significant improvement in profitability in FY24, driven by strong sales in EVs, commercial vehicles, and premium models【5†source】.

Competitors of Tata Motors

- Mahindra & Mahindra: Known for its SUVs and tractors, Mahindra has a growing EV segment.

- Maruti Suzuki: India’s largest car manufacturer by volume, competing in the passenger vehicle segment.

- Ashok Leyland: Focuses on commercial vehicles, especially buses and trucks.

- Hyundai Motor India: Strong presence in the passenger vehicle market, including EVs.

- MG Motor India: Known for its electric vehicles, such as the MG ZS EV.

Risk Factors

- Economic Slowdowns: Tata Motors is vulnerable to global and local economic slowdowns, which can impact vehicle sales.

- Competition in EV Space: Growing competition from local and international players in the EV market poses a challenge.

- Supply Chain Disruptions: Geopolitical tensions and semiconductor shortages can disrupt production lines.

Future Plans of Tata Motors

- Expansion in Electric Vehicles: Tata Motors plans to launch 10 EV models by FY26【source】.

- Sustainability: The company aims to achieve net-zero emissions by 2045 for commercial vehicles and 2040 for passenger vehicles.

- Global Expansion: Jaguar Land Rover will become an all-electric brand by 2030, positioning Tata Motors as a global leader in luxury EVs.

Profit and Loss Table (FY22-FY24)

| Year | Profit/Loss After Tax (₹ Crore) |

|---|---|

| FY22 | (11,309) |

| FY23 | 2,690 |

| FY24 | 31,807 |

Summary: After a challenging FY22, Tata Motors has significantly turned around its performance, posting substantial profits in FY24【source】.

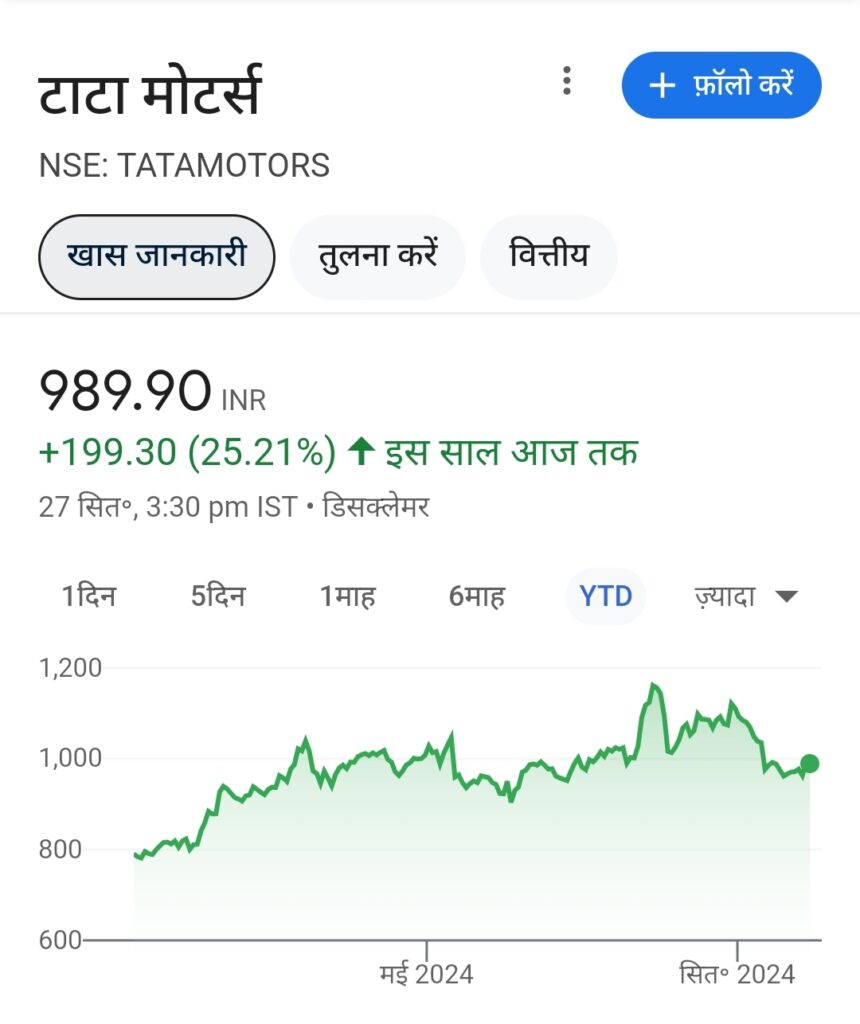

Tata Motors Share Price Last Year Chart

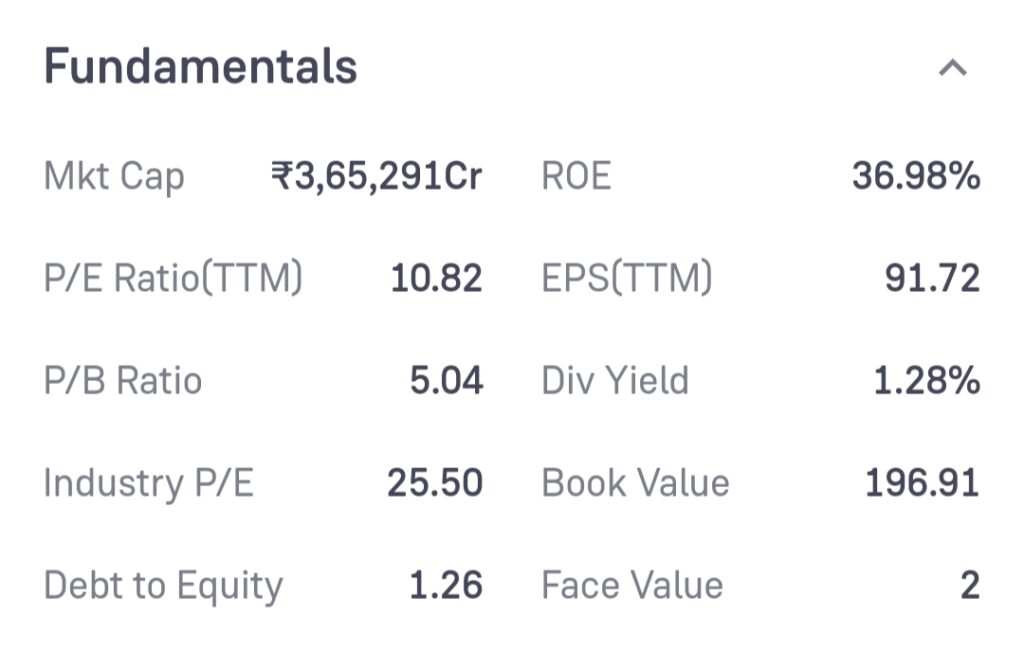

Tata Motors Fundamental

Pros and Cons

Pros:

- Market leader in EV technology.

- Strong global presence, especially in luxury vehicles through JLR.

- Commitment to sustainability and innovation.

Cons:

- Vulnerable to economic slowdowns.

- Intense competition in the EV market.

- Supply chain disruptions due to geopolitical factors.

Conclusion

Tata Motors has positioned itself as a key player in the future of global mobility, particularly in the electric and luxury vehicle segments. With strong financial growth, a clear commitment to sustainability, and ambitious plans for innovation, the company is well-poised for long-term success. Investors looking for a reliable and forward-thinking company may find Tata Motors a valuable addition to their portfolio.

Categorie Price Prediction

FAQs

Is Tata Motors stock a good buy?

Yes, with its dominance in the EV sector and strong financial performance, Tata Motors presents a good investment opportunity.

What is Tata Motors’ share price target for 2024?

The projected share price for 2024 is between ₹700 and ₹1,250.

Disclaimer: This is just an estimate that the share target of Tata Motors can be this much. If you want to invest then talk to an advisor and then invest. News.Homedecore24.com will not take any responsibility if your money is lost. Please invest money at your own risk.