By- Walton, Sep 20, 2024

Vedanta Limited is a leading player in the Indian mining and minerals sector, primarily involved in the extraction of metals like zinc, copper, and aluminum. With a robust presence on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), VEDL has made significant strides in its operational capacity and market reach.

Current Market Overview

As of September 19, 2024, VEDL shares closed at ₹449.75, reflecting a consistent upward trend over recent weeks. The company’s performance can be attributed to its strategic initiatives, robust demand for metals, and favorable market conditions.

Read More

✓ NTPC Share Price Target

Factors Affecting VEDL’s Share Price

- Global Commodity Prices: Fluctuations in the prices of metals significantly impact VEDL’s profitability.

- Economic Indicators: GDP growth, industrial production, and construction activities in India and globally influence demand for metals.

- Government Policies: Regulatory changes and incentives in the mining sector can affect operational costs and revenues.

- Technological Advancements: Investments in new technologies can enhance productivity and reduce costs.

- Market Sentiment: Investor perception and market trends play crucial roles in determining stock performance.

VEDL Share Price Target Predictions (2025-2026-2027-2028-2029-2030)

Vedanta Share Price Today News Moneycontrol

VEDL Share Price Target for 2025

In 2025, VEDL is expected to see a positive trajectory, driven by strong market demand.

| Month | Target Price (₹) |

|---|---|

| January | ₹810 – ₹812 |

| February | ₹826 – ₹828 |

| March | ₹843 – ₹845 |

| April | ₹814 – ₹816 |

| May | ₹787 – ₹789 |

| June | ₹762 – ₹764 |

| July | ₹791 – ₹793 |

| August | ₹823 – ₹825 |

| September | ₹856 – ₹858 |

| October | ₹873 – ₹875 |

| November | ₹890 – ₹892 |

| December | ₹908 – ₹910 |

Read More

✓ PNB Share Price Target

VEDL Share Price Target for 2026

As VEDL continues to capitalize on favorable market conditions, the following targets are anticipated:

| Month | Target Price (₹) |

|---|---|

| January | ₹926 – ₹928 |

| February | ₹945 – ₹947 |

| March | ₹964 – ₹966 |

| April | ₹932 – ₹934 |

| May | ₹901 – ₹903 |

| June | ₹871 – ₹873 |

| July | ₹906 – ₹908 |

| August | ₹942 – ₹944 |

| September | ₹980 – ₹982 |

| October | ₹1000 – ₹1002 |

| November | ₹1020 – ₹1022 |

| December | ₹1040 – ₹1042 |

Read More

✓ HINDPETRO Share Price Target

VEDL Share Price Target for 2027

With strong growth prospects, VEDL’s targets for 2027 are outlined below:

| Month | Target Price (₹) |

|---|---|

| January | ₹1061 – ₹1063 |

| February | ₹1082 – ₹1084 |

| March | ₹1104 – ₹1106 |

| April | ₹1067 – ₹1069 |

| May | ₹1031 – ₹1033 |

| June | ₹997 – ₹999 |

| July | ₹1037 – ₹1039 |

| August | ₹1079 – ₹1081 |

| September | ₹1122 – ₹1124 |

| October | ₹1144 – ₹1146 |

| November | ₹1167 – ₹1169 |

| December | ₹1190 – ₹1192 |

VEDL Share Price Target for 2028

Continued market optimism leads to robust targets for 2028:

| Month | Target Price (₹) |

|---|---|

| January | ₹1214 – ₹1216 |

| February | ₹1238 – ₹1240 |

| March | ₹1263 – ₹1265 |

| April | ₹1221 – ₹1223 |

| May | ₹1180 – ₹1182 |

| June | ₹1141 – ₹1143 |

| July | ₹1187 – ₹1189 |

| August | ₹1235 – ₹1237 |

| September | ₹1284 – ₹1286 |

| October | ₹1310 – ₹1312 |

| November | ₹1336 – ₹1338 |

| December | ₹1363 – ₹1365 |

Read More

✓ SBI Card Share Price Target

VEDL Share Price Target for 2029

Anticipating sustained growth, the following targets are set for 2029:

| Month | Target Price (₹) |

|---|---|

| January | ₹1390 – ₹1392 |

| February | ₹1418 – ₹1420 |

| March | ₹1446 – ₹1448 |

| April | ₹1398 – ₹1400 |

| May | ₹1351 – ₹1353 |

| June | ₹1306 – ₹1308 |

| July | ₹1358 – ₹1360 |

| August | ₹1412 – ₹1414 |

| September | ₹1469 – ₹1471 |

| October | ₹1498 – ₹1500 |

| November | ₹1528 – ₹1530 |

| December | ₹1559 – ₹1561 |

VEDL Share Price Target for 2030

By 2030, VEDL is projected to reach substantial targets:

| Month | Target Price (₹) |

|---|---|

| January | ₹1590 – ₹1592 |

| February | ₹1622 – ₹1624 |

| March | ₹1654 – ₹1656 |

| April | ₹1599 – ₹1601 |

| May | ₹1546 – ₹1548 |

| June | ₹1494 – ₹1496 |

| July | ₹1554 – ₹1556 |

| August | ₹1616 – ₹1618 |

| September | ₹1681 – ₹1683 |

| October | ₹1715 – ₹1717 |

| November | ₹1749 – ₹1751 |

| December | ₹1784 – ₹1786 |

Read More

✓ Nova AgriTech Share Price Target

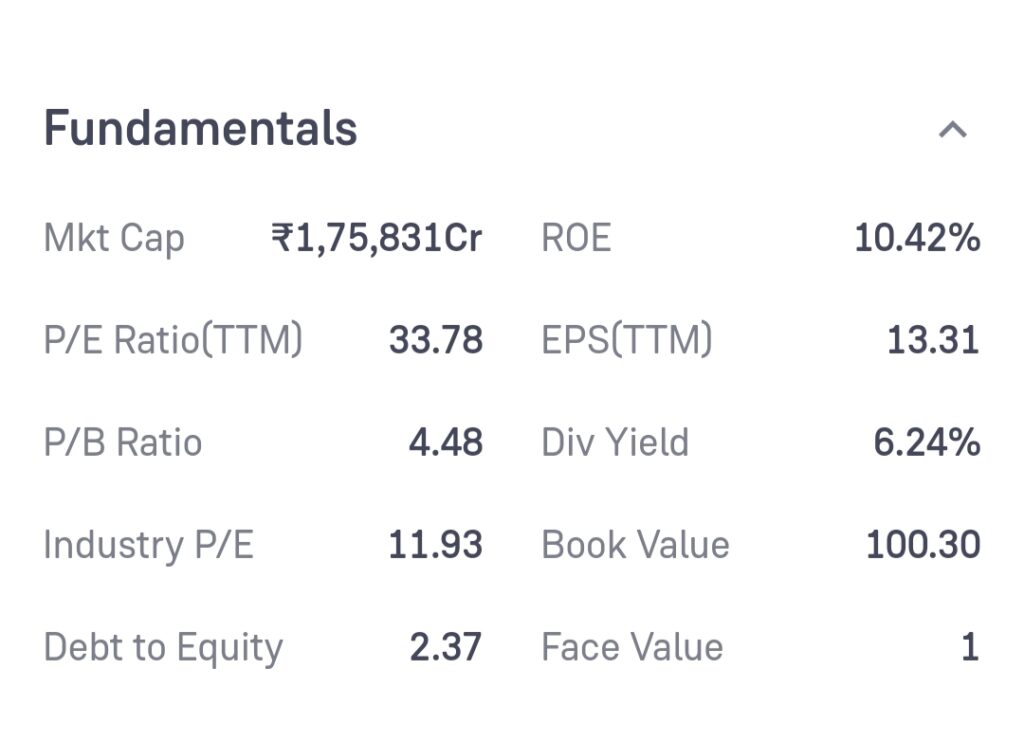

Vedanta Limited (VEDL) Share Fundamental

Vedanta Limited (VEDL) Share Chart

FAQs

1. What factors influence Vedanta Limited’s share price?

Factors include global commodity prices, economic indicators, government policies, technological advancements, and market sentiment.

2. How does the mining industry affect Vedanta’s performance?

The health of the mining industry directly influences VEDL’s operations, revenue, and stock performance due to demand for metals.

3. What are the risks associated with investing in Vedanta Limited?

Potential risks include market volatility, regulatory changes, and fluctuations in commodity prices.

Conclusion

In conclusion, Vedanta Limited is poised for significant growth from 2025 to 2030. With favorable market conditions and strategic initiatives, the share price targets reflect a bullish outlook. However, investors should remain vigilant about market dynamics and conduct thorough research before making investment decisions.

By staying informed and considering both historical performance and future projections, investors can navigate the opportunities within Vedanta Limited.