Welcome to another cost forecast post by News.homedecore24.com, Here in this article we will give total data about Rivian Auto Inc (NASDAQ: RIVN) alongside Rivian stock cost expectations for 2024, 2025, 2030, 2040, and 2050.

This post depends on our 8 years of involvement with the market. Trust you will like this Rivian cost estimate data, and if it’s not too much trouble, share this enlightening and important article with your companions.

What Is Rivian Automotive Inc?

Rivian Programmed Inc is an American electric vehicle producing organization established in 2009 by Robert “RJ” Frightening. The central command of Rivian is situated in Irvine, California, US.

The principal vision of Rivian is to fabricate SUV-type vehicles, for example, Pickup trucks or UTEs. Rivian has likewise created E-Vans for the biggest Web based business organization, Amazon.

The organization sent off its Initial public offering in Nov 2021 by raising more than $13.5 billion USD. Financial backers put resources into this organization with a dream that Rivian could turn into a significant contender of TESLA.

There are a ton of financial backers and dealers who are exceptionally keen on realizing Rivian stock cost expectations for 2025.

The above table showcase data about Rivian Auto, Inc. (RIVN) Stock Cost, market cap, and 52-week high and low alongside some other significant data like S&P500 52-Week Change in Rivian. Information from the above table was taken on 12/05/2022 from Yippee Money. To see live information then, at that point, look at here.

Read More: Lucid Stock Forecast 2024 – 2025 – 2030

Rivian Stock Price Prediction 2025

| Year | Rivian Stock Price Prediction 2025 |

| 2025 | $185 to $230 |

Rivian stock cost expectation for 2025 is $185.35 as the principal target and $230.46 as the subsequent objective. Generally, in 2025, the Rivian stock cost estimate is it could go from $188.34 to $246.45.

These cost expectations are reachable as interest for EV vehicles is expanding step by step and Rivian is getting outcome in laying out agreements for providing to different organizations.

Last year, Rivian protected an arrangement with Amazon for giving 100,000 electric conveyance vans, which pushed up interest for their electric vans. There is another EV creator in the market called Clear Engines.

We have explored and composed a nitty gritty post on What Will Be The Value Of Clear Engines’ Stock from 2022 to 2050. Peruse it to know more.

Rivian Stock Price Prediction 2030

| Year | Rivian Stock Price Prediction 2030 |

| 2030 | $745 to $845 |

Rivian stock cost expectation for 2030 is $745.34 as the main objective and $845.45 as the subsequent objective. Generally, in 2030, the Rivian stock value estimate could go from $745.34 to $845.45.

After Tesla’s digital truck, Rivian is the most famous brand in Pickup trucks (SUVs) and their plans are extraordinary and wonderful. As they are more centered around Utility trucks, so they could become one of the most mind-blowing EV producing organizations in the SUV class of vehicles. Their vehicles are intended for Rough terrain too, which makes them more remarkable all alone.

Once, the interest for EVs kicked in, then, at that point, the interest for EV vehicles will increment and individuals will purchase Rivian vehicles also which will expand their benefit. At last, the offer cost of Rivian will go up in 2025 and bit by bit increment till 2030 and could hit our objectives.

Rivian Stock Price Prediction 2040

| Year | Rivian Stock Price Prediction 2040 |

| 2040 | Around $1500 |

Rivian stock cost expectation for 2040 is around $1500. In 2040, Rivian will become 30 years of age organization and in the event that results of Rivian perform well on the lookout, without a doubt these cost targets are reachable.

As per the specialized examination made by our specialists, the cost target is 80% exact at the stock cost of Rivian in the years 2025, 2030, and 2040. In the event that the organization exist for a really long time, the trust and the brand worth will increment alongside the deals and the benefit of the organization.

Very much like Clear Engines and Rivian, there is another EV producer called NIO. We have investigated and composed a point by point post on What Will Be The Value Of NIO’s Stock from 2022 to 2050. Peruse it to know more.

Rivian Stock Price Prediction 2050

| Year | Rivian Stock Price Prediction 2050 |

| 2050 | Around $2349 |

Rivian stock cost expectation for 2050 is around $2349. These cost figures depend on specialized investigation made by various programming and instruments.

The principal part of an electric vehicle is its battery. Batteries resemble the foundation of each and every electric vehicle. Principally, these batteries are comprised of Lithium. On the off chance that the deals of EV will build, the deals of Lithium batteries will likewise increment. So being familiar with those organizations and their stocks is vital.

We have explored and chosen the Best Lithium Batteries Creators and their stocks. Peruse it to know more.

Read More: Zscaler Stock Forecast 2024 – 2025 – 2030

Should I buy Rivian stock?

Yes, according to our investigation Rivian is a decent stock to accept in light of many reasons, for example,

•They are principally centered around utility trucks, according to explore, carrying on with work ina specific specialty has more possibilities getting achievement.

- Presently, the EV blast needs to come. Along these lines, individuals who start early whenever some transformation is about have more possibilities getting achievement.

- As tesia is ruling EVs. What is your take? That main they will overwhelm in EV for the following ten years?

- Do you confide in long haul Venture? On the off chance that indeed, Rivian stock is a decent one to purchase now to hold for a year to create a monstrous gain. According to specialists, just those individuals who get progress in the securities exchange invests energy in it as opposed to timing it.

YouTube Video

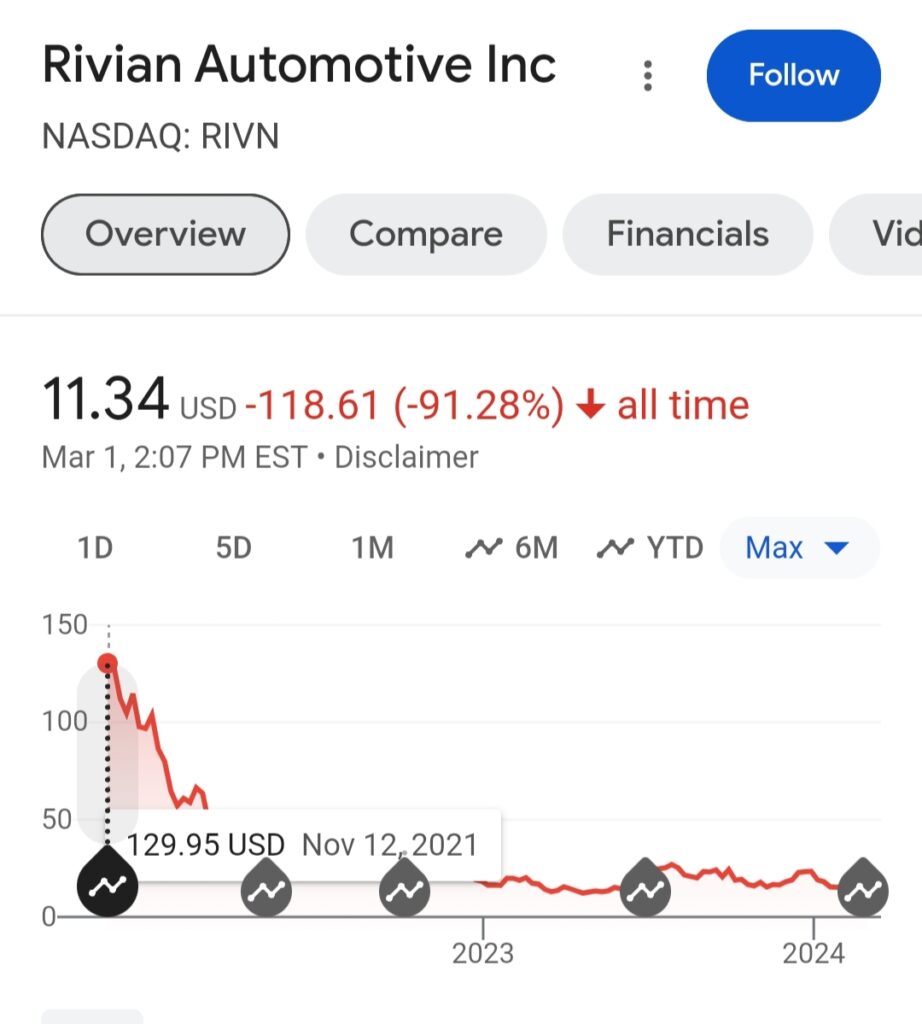

Rivian Stock All Time Performance

FAQ: People also ask

Should I Buy Rivian shares?

It relies upon your venture objectives. As of now, Rivian is dealing with issues underway in view of the production network. In this way, assuming creation is slow means less satisfaction of orders and less benefit. Thus, it very well may be a gamble to put resources into Rivian, and could turn out to be great too, everything relies upon creation right now.

Will Rivian Stocks Grow In The Future?

Yes, in the securities exchange you can’t say it will develop or not also everything relies upon the basics of the organization too. 200,000 vehicle conveyance is normal by 2025 with $25.8 billion in income. 701,918 vehicle conveyance is normal by 2030 with $78.7 billion in income. In this way, from these figures, you can expect what could occur.

Why Is Rivian stock So Low?

Presently, the organization is dealing with issues with large scale manufacturing and conveyance because of store network deficiencies. Less conveyances of vehicles mean less deals, and less deals mean less benefit. an organization isn’t creating a gain, it is sure that its portion cost will go down or that there are any issues happening inside the organization’s administration.

Nowadays, the news is becoming viral about the forthcoming downturn. In this way, individuals are frightened nowadays and don’t place their cash into shares rather they are unloading shares which makes the stock costs go down

Are Rivian Stocks Overpriced?

Yes, Rivian stock is overpriced based on its production, which is currently affected due to supply-chain shortages around the globe.

What Is The Prediction For Rivian Stock?

Rivian stock price prediction for 2025 is $188.34 to $246.45.

Rivian stock price prediction for 2030 is $745.34 to $845.45.

Rivian stock price prediction for 2040 is around $1500.

Rivian stock price prediction for 2050 is around $2349

Will Rivian Stock Recover?

Sure, given that the company is growing stronger every day and gaining more and more customers for their trucks, Rivian stock will eventually rise again.

What Will Rivian Stock Be Worth In 5 Years?

According to study, Rivian’s stock price will trade over $500 and return to three digits in the next five years.

Is Rivian Publicly traded Company?

Indeed, Rivian stock is listed on the NYSE and available for trading, under the ticker RIVN.

What is Rivian stock price prediction for 2025?

The projected price range for Rivian stocks in 2025 is $185 to $230. By the end of 2025, RIVN can easily hit these price expectations.

Is Rivian Stock A Good Buy?

Yes, it’s a terrific deal at the current price of around $32 USD. The corporation now has over $16 billion in cash on hand, and while revenues are growing steadily, they are also putting more of an emphasis on its products. Rivian trucks are more appealing to consumers because of their attractive appearance.

The Bull Case For Rivian

As a pioneer in the EV industry, Rivian is now the first manufacturer to provide EV trucks to its customers. They already have thousands of pre-orders in their possession and have a significant number of individuals bonded to their vehicles. In 2022, Rivian just signed an agreement with Amazon.INC to supply them with electric trucks for delivery and pickup.

The Bear Case For Rivian

Rivian has only manufactured about 6,000 E-cars since May 2022, but they anticipate generating close to 25,000 vehicles by the end of the year. Compared to other rivals like Ford, who sold over a million cars in 2021, and Tesla, which manufactured over 300,000 cars in the first quarter of 2022, Rivian’s manufacturing pace is significantly lower.

The Bear Case For Rivian

Rivian has only manufactured about 5,000 E-cars since May 2022, but they anticipate generating close to 25,000 vehicles by the end of the year. When compared to other rivals like Ford, who sold over million cars in 2021, and Tesla, which produced over 300,000, Rivian’s manufacturing pace is far lower.

Bottom Line

The market capitalization, share price, PE ratio, 52-week low, and high of Rivian Automotive Inc. (NASDAQ: RIVN) were all covered in this poem. The major discussion point of this piece was the Rivian stock price projections for 2025, 2030, 2040, and 2050, which were based on professional technical analysis, past prices, and news from the market.

If you enjoy reading this post, please tell your friends about it. You may also explore other subjects on our website, including stock market updates, cryptocurrency, and NFTe. Thank you very much once again.